There’s a moment every foreigner in Spain encounters sooner or later — someone asks for “your NIF”, even though you’re holding a freshly issued NIE in your hands. The terms seem interchangeable, and sometimes locals use them as if they were. But they’re not the same, not in the legal sense. And yet… for most people, one number ends up doing double duty. A small paradox of Spanish bureaucracy.

Below is a grounded, human explanation of how it all really works. No stiff official tone, no over‑simplifications — just a clear, practical guide you can actually read without losing the thread.

Quick answer

No — NIE and NIF are not the same, although the same number often ends up serving both purposes.

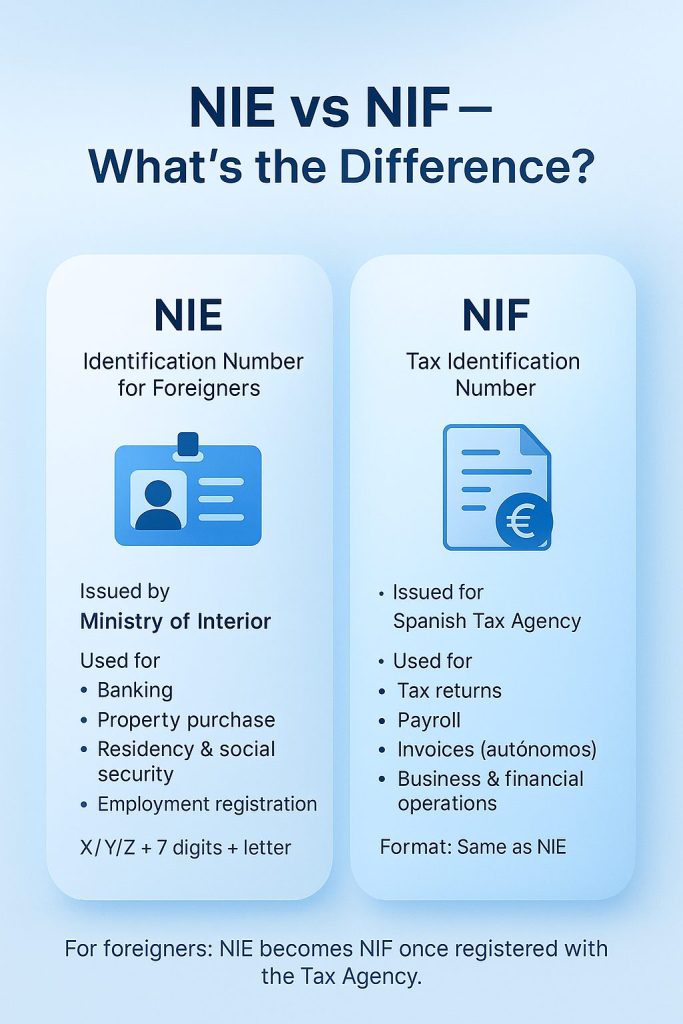

- NIE is your foreigner identification number. It’s issued by the Spanish National Police under the authority of the Ministry of Interior. You’ll use it to identify yourself everywhere — banks, notaries, landlords, government offices.

- NIF is your tax identification number. It’s the number the Agencia Tributaria (Spanish Tax Agency) uses to link all your tax‑related information: income, invoices, declarations, and investments.

For foreigners, the process is straightforward: once your NIE is registered with the Tax Agency, the same number becomes your NIF. One number, two roles.

If you’d rather avoid appointments, queuing systems and language confusion, both NIE and NIF can be arranged remotely through accredited representatives. E‑Residence provides compliant online services for obtaining your NIE online and NIF online.

Introduction

Spain’s identification system looks straightforward on the surface. A single number for citizens; another system for foreigners. That’s the theory.

But once you start opening a bank account, signing a rental contract, or preparing to buy property, the acronyms begin to blend together. “Put your DNI/NIE/NIF here”, says one form. A bank clerk asks for your NIF even though you only have an NIE. People around you seem to use both terms as if they mean exactly the same thing.

They don’t. Not officially.

NIE identifies you as a foreigner inside the Spanish administrative structure. NIF ties you into the fiscal system. And although these two categories overlap, they don’t merge automatically. A small piece of bureaucracy — usually a registration with the Tax Agency — connects them.

This guide walks you through that connection. What each number is for. When you’ll need one, the other, or both. And how to navigate the system without drowning in forms.

What is NIE?

A simple definition

NIE — Número de Identidad de Extranjero — is the number Spain assigns to non‑Spanish nationals who need to interact with local authorities. Think of it as your administrative identity inside the country.

It’s:

- just a number (not a card),

- issued and managed by police and immigration offices under the Ministry of Interior,

- the reference used by all other institutions — tax, social security, healthcare.

Once you have it, you keep it for life. Even if you leave Spain. Even if your residence status changes.

Who needs it?

Most foreigners do. You’ll need an NIE if you’re planning to:

- stay longer than a standard tourist visit,

- buy a home, invest, or sign a reservation contract,

- open a Spanish bank account,

- start a job or freelance activity,

- register with social security,

- appear on official documents or notarial acts.

In real terms, the NIE is your “entry ticket” to Spanish bureaucracy.

Format

X / Y / Z + 7 digits + 1 control letter

Example: X1234567A

The starting letter depends on historical issuance rules — not something you need to worry about.

Why you will use it constantly

After obtaining it, your NIE becomes the number that:

- appears on bank papers, mortgage files, investments,

- goes into employment paperwork and payroll,

- links you to the healthcare system,

- shows up in residency procedures,

- eventually becomes the base for your NIF.

Without it, almost nothing moves.

What is NIF?

What the number really does

NIF — Número de Identificación Fiscal — is your tax number. The one the Agencia Tributaria (Spanish Tax Agency) uses to identify you in every fiscal context.

This includes:

- income tax returns,

- VAT or withholding obligations,

- property‑related taxes,

- investment reporting,

- communication with employers or clients.

Who uses it?

- Spanish citizens: their DNI number doubles as their NIF.

- Foreign individuals: their NIE becomes their NIF once registered with the Tax Agency.

- Companies: receive their own dedicated NIF starting with a letter.

Formats

Citizens: 8 digits + letter (12345678A)

Foreigners: same structure as NIE (X1234567A)

Companies: letter + digits + letter (B1234567R)

Why NIF matters

Your NIF is needed for:

- invoices you issue,

- income declarations,

- payroll integration,

- company creation,

- investment accounts,

- property taxation,

- rental income reporting.

If something is fiscal, it requires a NIF.

NIE vs NIF: key differences

Although the same number may eventually serve both functions, NIE and NIF are legally different.

| Aspect | NIE | NIF |

| Purpose | Identification of foreigners | Tax identification |

| Authority | Ministry of Interior / Police | Tax Agency |

| Applies to | Foreign individuals | Citizens, foreigners, companies |

| Format | X/Y/Z + digits + letter | DNI format, NIE format, company format |

| Used for | Banking, immigration, property, residency | Taxes, invoices, payroll, fiscal records |

| Validity | Permanent | Permanent |

The key idea: NIE identifies you; NIF taxes you.

How NIE becomes your NIF

This is the part that confuses everyone.

A foreigner gets an NIE. Feels done. Files a tax form — suddenly, people start calling the number a NIF. What happened?

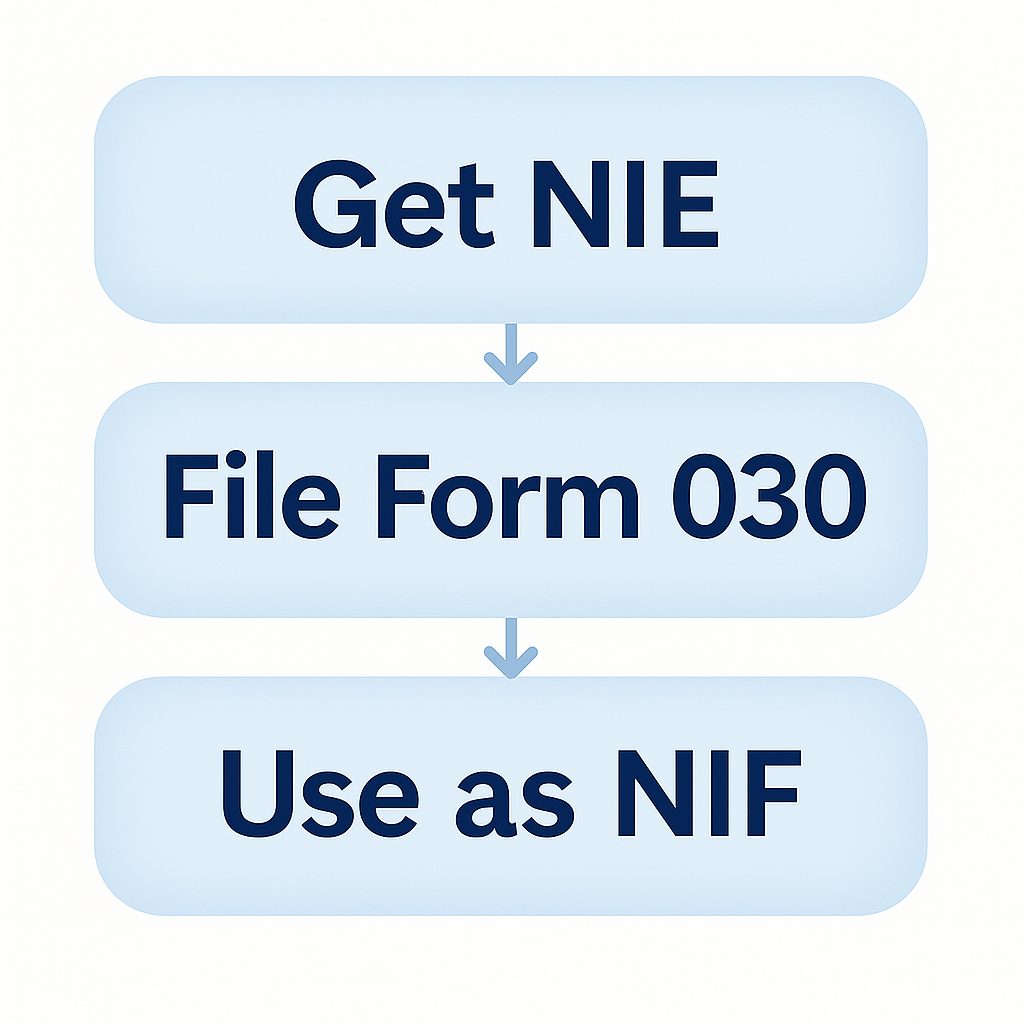

The mechanism, without the jargon

- You obtain an NIE. At this stage, it’s only an identification number.

- At some point — through employment, property purchase, or a simple Form 030 — the Tax Agency registers that NIE.

- The moment it’s in their system, that NIE becomes your NIF for all fiscal purposes.

Same number, expanded function.

Real‑life example

Ivan, a non‑EU investor, gets NIE X9876543Z to buy an apartment. His lawyer files Form 030. The Tax Agency enters Ivan into the system.

From that point on, the same number — X9876543Z — is used:

- on his deed,

- in non‑resident income tax,

- in future financial operations.

Temporary “M” NIF

In rare situations, someone needs a tax number urgently before their NIE is issued. Then the Tax Agency may assign a temporary NIF beginning with M. Later, it’s replaced by the permanent NIE‑based NIF.

When you’ll be asked for each number

You’ll need an NIE when you:

- open a bank account,

- sign a rental contract,

- buy property,

- apply for residency,

- register with social security,

- work for a Spanish employer,

- handle notarial processes that involve money.

You’ll need a NIF when you:

- file tax returns (resident or non‑resident),

- issue invoices as a freelancer (autónomo),

- report rental income,

- create or manage a company,

- sign financial agreements,

- handle any fiscal matter.

Often, you will need both, but under one and the same number.

How to obtain NIE and activate it as NIF

Step 1: Obtain your NIE

Three possible paths:

- In Spain, in person at a police or immigration office. You’ll need your passport or EU ID, Form EX‑15, justification, and an appointment.

- Through a Spanish consulate if you’re still abroad. Timelines vary — sometimes days, sometimes months.

- Through a legal representative, using a power of attorney. This is the simplest option for most people who aren’t yet in Spain or don’t speak Spanish.

Step 2: Register it with the Tax Agency.

This is usually done via Form 030. The form links your NIE to the fiscal system and defines whether you’re resident or non‑resident for tax purposes.

Registration can happen:

- in person,

- or online through a representative.

Step 3: Corporate NIF

If you open a company, the entity receives its own separate NIF through Form 036 and the commercial registry.

Official references

If you want to double‑check anything, these are the primary official sources:

Everything published in Spain eventually traces back to these three.

FAQ

Do I need both numbers?

Not as separate numbers. You get an NIE — then the Tax Agency turns it into your NIF when needed.

Can I use my NIE for taxes immediately?

Sometimes yes, but it’s safer to assume you should register it first.

Does NIE expire?

The number — no. Residence permits may expire, but the NIE stays linked to you.

Is NIE the same as TIE?

No. TIE is a physical residence card. NIE is just the number.

How long does issuance take?

Anywhere from a few days to a few months depending on where and how you apply.

Conclusion

Spain’s system seems complicated when you first meet it — partly because terms blur together in everyday speech. But once you understand the architecture, it starts making sense.

NIE identifies you. NIF connects you to the fiscal world. One number can do both, once it’s in the right database.

If you’re planning a move, an investment, or long‑term work in Spain, taking care of NIE/NIF early saves you time and preventable mistakes. And if you prefer not to wrestle with appointments and forms, services like E‑Residence help tie the whole process together smoothly — exactly the way the system was meant to work.

Last updated: 20.11.2025