NHR for Digital Nomads

The Non-Habitual Resident (NHR) regime in Portugal is a special tax program designed to attract foreign residents, including digital nomads, retirees, and high-net-worth individuals. It offers significant tax benefits, such as a reduced tax rate on foreign income and some Portuguese-sourced income for a period of 10 years. The NHR regime is popular among those looking to relocate to Portugal due to its favorable tax incentives and simplified residency requirements.

e-residence can guide and assist you throughout the entire NHR process.

It is crucial to ensure proper compliance with the applicable formalities in the year of relocation and in the subsequent years of residence in Portugal in order to fully benefit from the potential advantages of the NHR regime.

We offer a one-stop shop for all NHR related requirements of your move to Portugal, which include the following tax services:

- Initial personalized briefing on the NHR regime

- Arrival or registration formalities

- Applying for the NHR status

- Analysis and preparation of a High Value Added Activity

- Filing of personal income tax returns

- Ongoing tax and social security advice

Overview of the NHR regime benefits

0% tax on dividends

Foreign sourced dividends are taxed at 0%

0% tax on wealth

Portugal has 0% wealth tax, unlike other European countries

0% tax on foreign income

As determined by the applicable Tax Treaty or the OECD model tax convention, if no Tax Treaty is in force between Portugal and the country of source

20% tax on self-employment

Self employment (freelance) and employment considered as high value professions are taxed at 20%

No minimum stay requirement

There is no minimum stay requirement for EU citizens, if they have a rented or owned place to live

Fast track to an EU passport

After 5 years of living in Portugal, you can apply for Portuguese citizenship

The NHR regime makes Portugal one of the most attractive destinations for digital nomads, entrepreneurs and investors.

How can you apply for NHR status online?

Fill out a quick online application form

Upload all required documents

Receive your NHR confirmation documents

From Those Who've Experienced Excellence

Those who have already used our services note the convenience, speed and reliability of document processing. Find out first-hand how easy and effective it is to obtain NIF, NISS, open a bank account or obtain NHR tax status with our help.

FAQ

What is NHR?

As a part of its effort to attract foreigners, Portugal introduced the “Non Habitual Residency” tax regime which is commonly referred to as simply NHR. This regime encompasses a number of tax exemptions and privileges and its main aim is to provide an opportunity to optimise taxes for certain groups of people.

NHR and cryptocurrencies?

Currently with NHR in Portugal it is very convenient to trade and receive benefits from cryptocurrencies.

What kind of exemptions exist under NHR?

Generally speaking, most foreign-source income is tax exempt in Portugal, however there are conditions that must be met in order for this to apply.

What is necessary to register as NHR?

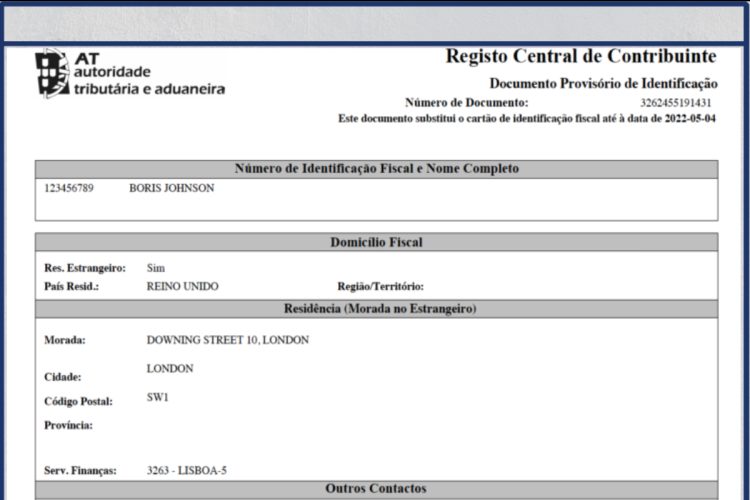

In order to register as NHR, you need to have a NIF (no worries if you don’t have one, as you can always apply through our platform), and a permit to stay legally in Portugal (EU citizenship or Portuguese residency). You will also need to provide us with access to "portal das finanças", in order for a member of our legal team to change your fiscal status (you can change the password after we are done with your application).

How long does this process take?

Once you fill out your application and pay the fee, our legal team will complete the procedure to request the NHR status for you. On average it takes 2-3 weeks to handle this request.

What are the advantages of NHR?

Basically speaking, the NHR allows you to optimise your tax payouts and greatly reduce what you owe in taxes to the government. Even though it sounds sketchy, but this is a completely legal regime that functions according to all tax laws and it is globally renowned and accepted.

How can I get CRUE for EU citizens?

Many individuals who have undergone the process of obtaining an NHR or changing their tax residence have been asked by tax authorities to provide a СRUE. Recognizing this common challenge, we have written a comprehensive article detailing how to secure this document. Please follow this link to the article.

Can I move to Portugal to avoid taxes?

Portugal can be very tax-friendly for expats. While income is taxed at progressive rates of up to 48%, there are ways to reduce taxes on your investment and pension income.

What is the missed deadline for NHR?

A tax resident must apply to obtain NHR status until the 31st of Marth, during the year following the year of becoming a tax resident.

How do I prove my tax residency in Portugal?

The Tax Residence Certificate is a document issued by the Portuguese tax authorities attesting that the person is considered tax resident in Portugal in a given fiscal year under the terms of the Portuguese tax law and for the purposes of the application of conventions to eliminate double taxation.

Can a Portuguese citizen get NHR?

Portuguese citizens wishing to return to Portugal after residing in another country in the last five years.

What happens to NHR after 10 years in Portugal?

After 10 years and, if you stay in Portugal, must pay tax at standard Portuguese rates going forward.

What is the NHR tax rate in Portugal?

A special tax rate of 20% applicable to employment and self-employment income derived from a “high value-added activities”.

How do I become a NHR in Portugal?

In order to register as a Non-Habitual Resident, applicants must meet the following requirements:

Be over 18 years;

Reside legally in Portugal;

Have tax residency status;

Not have been a tax resident for five years before the date of application.