Apply for Portuguese NIF online

Getting a Portuguese Tax ID (NIF) is crucial if you're planning to relocate to Portugal. With a NIF, you'll be able to legally operate your business in the country and enjoy its favorable tax regime. Ready to get started? E-Residence ensures you have everything you need to successfully launch your remote business in Portugal. Don't miss out on the benefits that come with having a Portuguese Tax ID – Take the first step and we’ll handle the rest.

Apply now and get your NIF in 24 hrs.

We have provided automated services with a guarantee and without bureaucracy.

- All you need just simply submit 2 documents online

- No need to spend time to catch appointments

We simplify the process of NIF registration and make it as easy as it gets!

What’s the NIF process?

Select your timeframe

Fill out a quick online form

Verify your identity

100% money-back guarantee

You just need 2 documents to get started

Our team has developed a thorough guide that outlines all the necessary documents and requirements for your NIF application. To access this helpful resource, please click the button below.

From those who've experienced excellence

Hear directly from our customers about the ease and efficiency of our services.

Why work with E-Residence?

Complete the process 100% remotely. We work directly with the Tax Department to handle your documents for you.

Trusted by 15,000+ nomads, we assure you that your private documents are secure and in good hands.

Time is money. We work quickly to ensure you get your NIF from 3 days according to your timeline.

E-residence.com is a dedicated team of legal professionals, based in Portugal and offering its clients a very comprehensive list of services available 100% online.

With 100% money back guarantee!

Got questions?

We’ve got answers. Take a look at our most frequently asked questions.

What is a NIF?

NIF, more commonly referred to as simply “Contribuinte” stands for “Número de Identificação Fiscal” which translates as the Number of tax identification, is the first step and the cornerstone for any economic activity in Portugal. It is required for both residents and non-residents of Portugal that wish to open a bank account, do any kind of deals with real estate, acquire a residence permit, contract an internet provider, etc. Hence, if you are considering moving to Portugal, conducting any kind of business activities or even simply staying here for prolonged periods of time - registering NIF is a priority.

How long does it take to acquire a NIF?

Generally it takes from a couple of hours to a couple of days to issue a NIF in Portugal online, however it should be noted that the time depends first of all on the AT office and there have been cases when clients have waited up to a month to get their NIF. Please, take a note that the timeframe counts from the day of signing the Power of Attorney.

Does a NIF ever expire?

Which authority issues NIF?

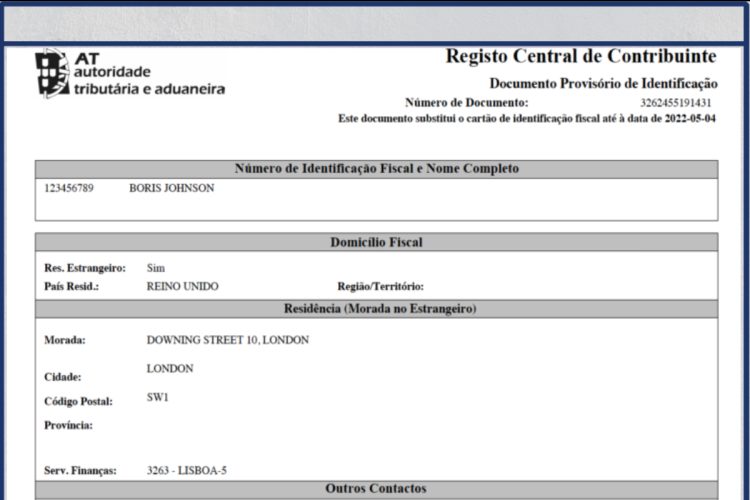

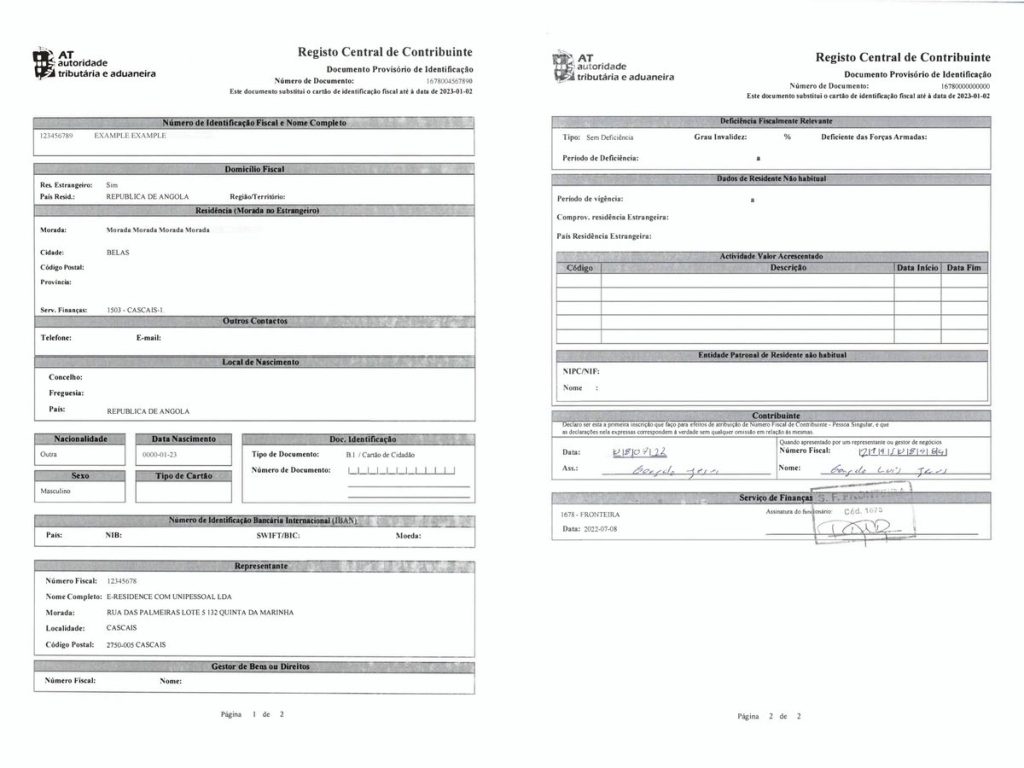

The document is issued by “Autoridade Tributária e Aduaneira” (Tax and Customs Authority) and contains all tax and financial information of its holder. For non residents it is required to have a local tax representative.

What is this “tax representation”?

Can I change a fiscal representative/address/data in my NIF?

How long does tax representation last?

According to the contract, our tax representation lasts 1 year, however it can be renewed. At the end of that year, your fiscal representation will automatically be renewed at a rate of €99/year. You may cancel this service after you become a Portugal tax resident and update your address with the tax office. More info about link.

How can I make a NIF for kids?

Required documents for NIF for minors:

- scan of child's passport

- a birth certificate translated to English or Portuguese with an apostille (we offer the service of translation and notarization)

- scans of both parents' passports

- NIF certificate of at least one parent

Can I get a password for “portal das financas”?

Yes it is possible to request a password for this portal. In this case it will be sent to us and we will forward it to you.

Via link, you can find more info about password.

How will I receive my NIF?

In 100% cases, we send NIFs online in a PDF format. As soon as we get your document - we will send it to the email and WhatsApp you provided us.

Also, when you apply, you can add mail delivery.

What if i had temporary NIF?

How to apply for NIF number in Portugal online?

To get a NIF (Número de Identificação Fiscal) online through e-residence.com, the process involves a few simple steps. Step 1: You start by filling out a quick online application form. Step 2: You provide two required documents—proof of identity, such as a valid passport or EU national ID card, and proof of address, which could be a utility bill, bank statement, or driver's license issued within the last three months. Step 3: After submitting the documents, your identity is verified, and the e-residence team handles the application directly with the Portuguese tax authorities. Within three to five days, you receive your NIF digitally, and the service comes with a 100% money-back guarantee if anything goes wrong.

How do I get proof of address in Portugal?

How can I check my NIF number in Portugal?

How can I get a free NIF in Portugal?

Can you work in Portugal without a NIF?

Do you need a Portuguese address for NIF?

Do I need a NIF to buy a house in Portugal?

Is TIN and NIF the same in Portugal?

Yes, also known as a Taxpayer Number, or referred to simply by the Portuguese initials NIF, it is composed of nine digits and is used by the Treasury to identify people with taxpaying obligations.

Be sure to check out our additional dependable services that assist nomads in making their transition to life in the EU as seamless and comfortable as possible, all from the convenience of their own homes.