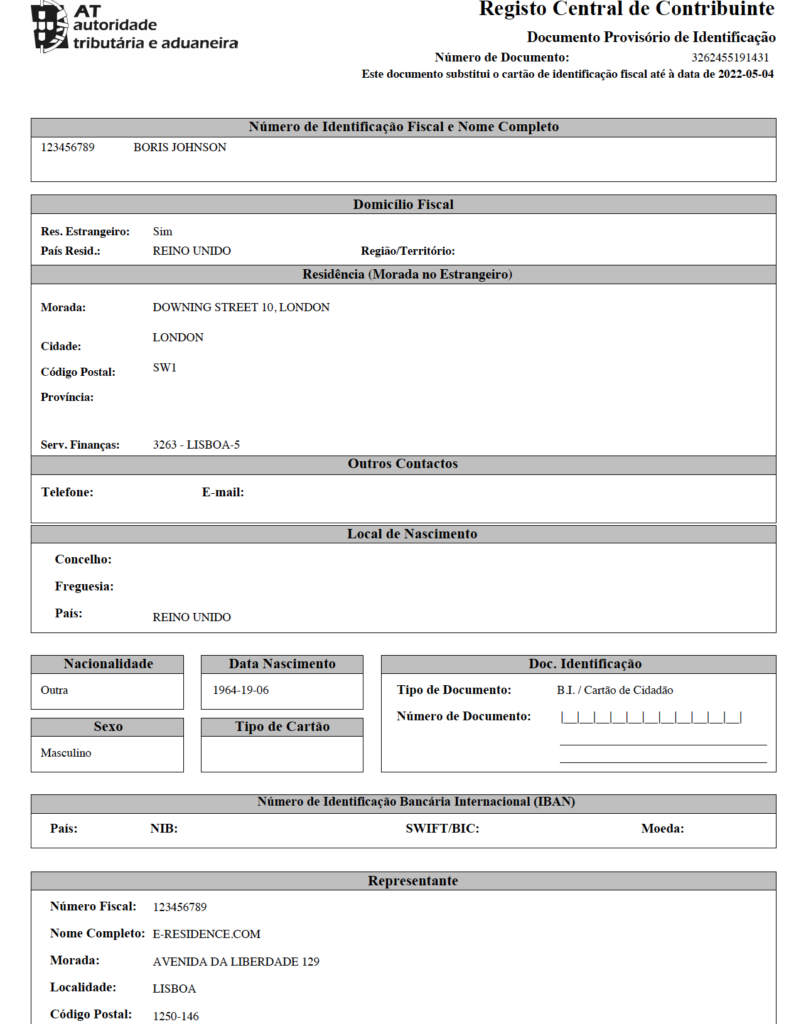

Portugal fiscal representative

All non-EU residents including UK expats who own property, hold a bank account or have any other commercial activity or interest in Portugal must by law appoint a Fiscal Representative that is registered with the Tax Department.

The Fiscal representative in Portugal must be registered on their behalf to receive any tax department correspondence and ensure compliance within the legal deadlines.

They are responsible for informing you of your tax obligations, applicable laws and deadlines. Notifications from the Tax Department generally require a prompt response within 10 to 15 days. If these obligations are not fulfilled, it may result in fines, among other penalties.

All non-EU residents must have a Fiscal Representative in place BEFORE requesting a Portuguese fiscal number.

Please, note, it's Not an Option! If you are not an EU citizen, you are obliged to name a tax representative. If you fail to do this, you’ll be fined from 150€ to 7.500€. Even if you’re living in the EU, there are major benefits in naming an expert dedicated to deal with your fiscal matters in a timely and efficient manner.

From Those Who've Experienced Excellence

Hear directly from our customers about the ease and efficiency of our services.

Prepare your documents:

– Passport

– NIF

– Proof of address

Submit application form

in 2 minutes and pay €99 processing fee

Complete identity verification in 2 minutes

Make a signature in the application to e-sign it in your form

Receive your NIF up to 10 working days

- NIF (Número de Identificação Fiscal) or Número de Contribuinte - number Portuguese tax identification.

- Proof of address outside Portugal in English (By signing you agree with our terms and conditions, change of address and obtain tax representative in your NIF.)

- Passport

If you are wrongly registered with Financias in Portugal as being resident in Portugal for tax purposes you may be liable to declare your worldwide income in Portugal. Any Tax Department correspondence could also be sent to the wrong address. If your IMI property tax bill is sent directly by the Tax Department to your Portuguese property, you are definitely registered as being fiscally resident in Portugal!

If your representative received something on your name, usually it can be notification to pay taxes we'll scan it and inform you, if you need, we can re-send it on your address.

You are only obliged to appoint a tax representative when you : register as a non-tax resident in Portugal and indicate an address in a country if you register as a non-tax resident in Portugal and indicate as your tax domicile an address in a country that does not belong to the European Union or the European Economic Area.

This obligation applies whether or not you are a national of a country that belongs to the European Union or the European Economic Area. Only your tax address is relevant, not your nationality.

Only individuals or companies, who are tax resident in Portugal, may be appointed as tax representatives.

The Tax Representative must be appointed at the time you register as a non-tax resident in Portugal with the Portuguese Tax Authority.

If you are a holder of a Citizen Card, the process of appointing a representative must be subsequent to the change of address on the Citizen Card.

The appointment of a fiscal representative requires the express acceptance by the representative of such appointment. To appoint a fiscal representative in Portugal the following documents will be required: – Identification document (citizen card or passport) of both the person who will register as non-resident, as well as the tax representative (in case the tax representative is an entity, the permanent certificate will be required); – Declaration of the person nominating the fiscal representative (to be prepared by us); – Declaration of the tax representative accepting the appointment (to be prepared by us) – Power of Attorney granting us powers to represent you before the Tax Authority.

Yes, we do provide a tax representation service. Please contact us if you would like our assistance – here.

The law allows a tax representative to resign as tax representative if one year has elapsed since appointment. This process of cancellation of tax representation follows a specific procedure and may take some months. Note that an individual cannot register as a non-resident (i.e. change his/her tax status from resident to non-resident for tax purposes) if he/she is registered as the tax representative of another taxpayer (individual or company).