For non-residents, obtaining a Portuguese NIF (Número de Identificação Fiscal) is essential for participating in Portugal’s financial and legal systems. This tax identification number is mandatory for activities such as opening a bank account, buying or renting property, initiating business ventures, or receiving income within the country. It enables the Portuguese government to track financial transactions and ensure tax compliance, making it a foundational document for any long-term engagement in Portugal. For non-EU/EEA residents, the process can be more complex, often requiring a fiscal representative, but it is manageable through specialized services.

E-Residence offers a streamlined online service that simplifies the process for non-residents needing a NIF. Rather than navigating Portugal’s in-person tax office procedures or appointing a local representative, applicants can now secure their NIF from anywhere through E-Residence’s online platform. This remote process is particularly advantageous for those living outside Portugal, allowing them to handle their tax identification requirements efficiently and without the need for extensive paperwork or local assistance. E-Residence’s service is designed to save time and reduce administrative hurdles, making it a practical solution for international clients.

What is a NIF number?

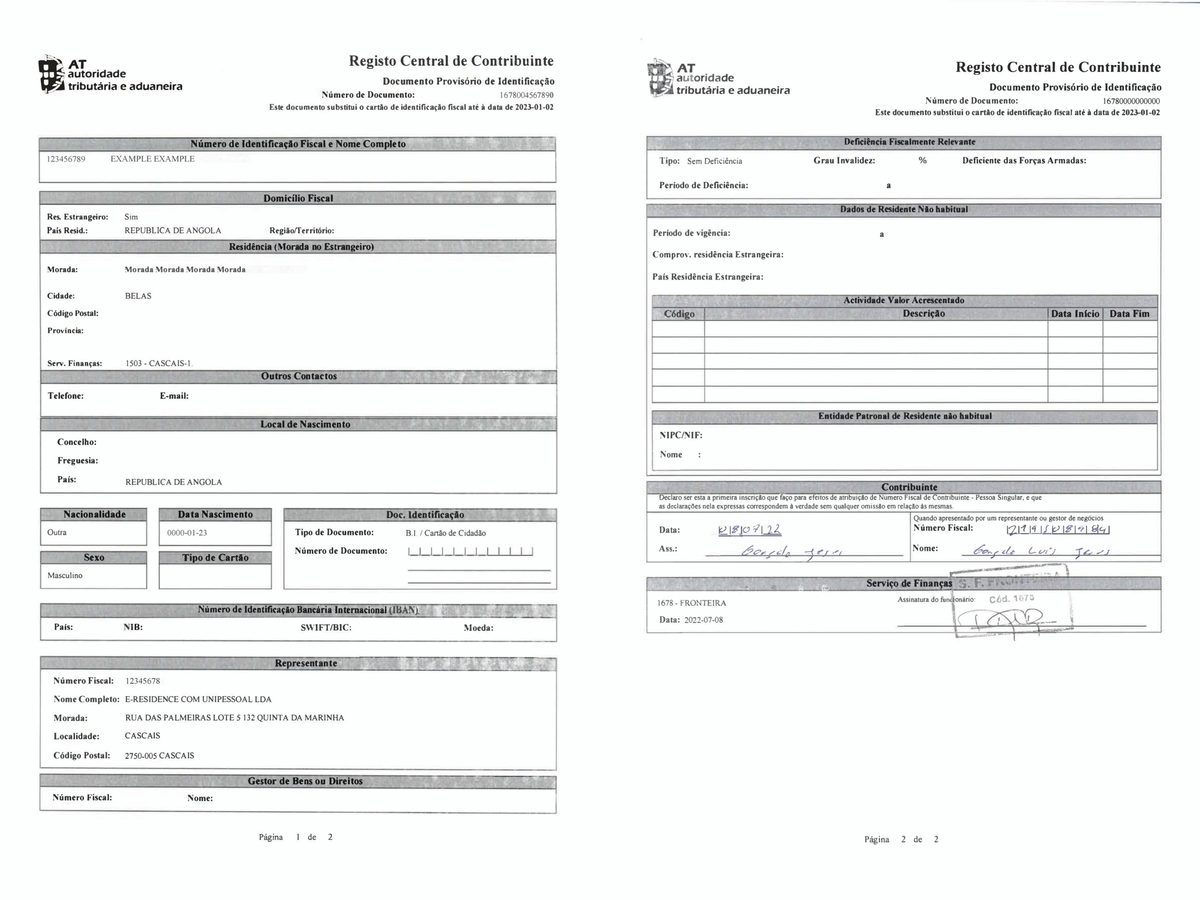

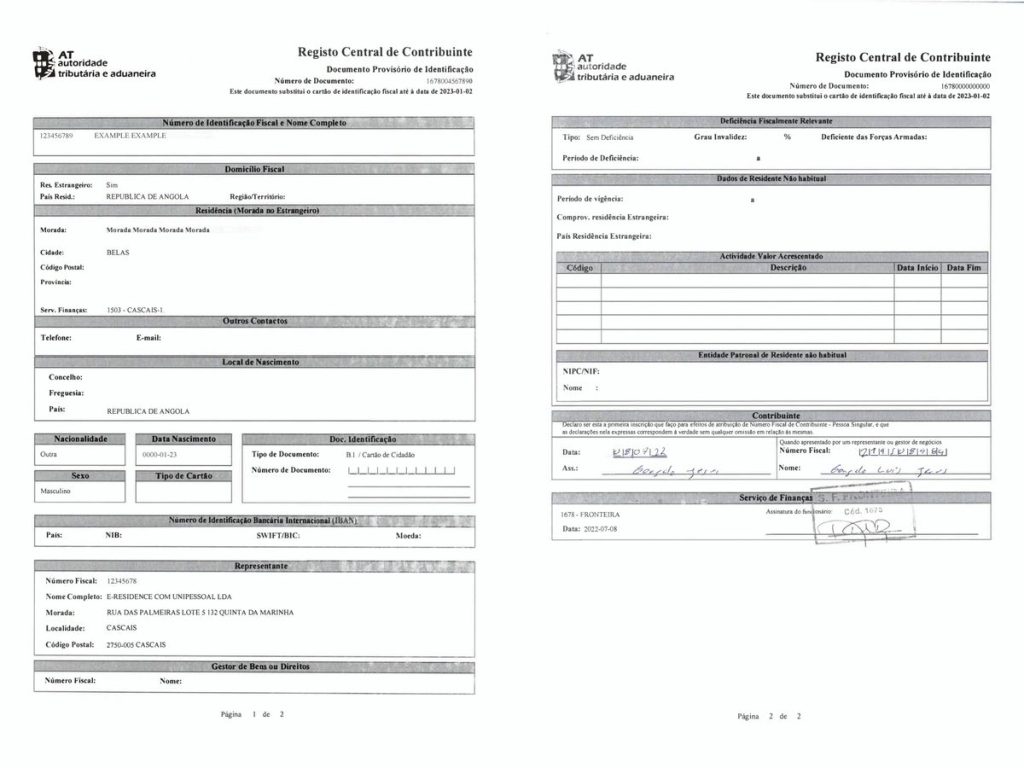

A NIF (Número de Identificação Fiscal) is Portugal’s tax identification number, issued to individuals and entities for tax purposes. Similar to a Social Security or Tax ID number in other countries, the NIF is used by the Portuguese government to identify taxpayers and track financial activities for tax compliance. Issued by the Portuguese Tax and Customs Authority, the NIF is a nine-digit number required for a range of financial and legal transactions in Portugal. Anyone planning to engage with Portugal’s financial system—whether as a resident or non-resident—needs this identification number to participate in various official activities.

Why non-residents need a NIF

Non-residents need a NIF in Portugal for several critical reasons. First, it’s necessary for opening a Portuguese bank account, which many non-residents seek to manage finances locally, invest, or establish a business. A NIF is also required for purchasing property, signing utility contracts, registering a business, or even accessing certain government services. Additionally, for non-residents generating income in Portugal—whether from rental properties, investments, or other sources—the NIF is essential for tax registration and fulfilling tax obligations in compliance with Portuguese law. Essentially, the NIF allows non-residents to interact with Portugal’s financial and legal systems efficiently, supporting smoother engagement with local regulations and business practices.

Requirements for obtaining a NIF

Non-residents can obtain a NIF to access financial, legal, and administrative services in Portugal. Generally, any non-resident seeking to interact with the Portuguese tax system or conduct specific transactions, such as buying property or opening a bank account, is eligible to apply for a NIF. However, non-residents outside the EU/EEA typically need a fiscal representative—often a lawyer, accountant, or trusted local contact in Portugal—who can assist with the application and act as a point of contact for tax matters on behalf of the applicant. This representative becomes the primary address for all official tax-related communications.

Documentation needed

The required documentation for obtaining a NIF as a non-resident is straightforward but varies slightly based on residency status and application method. Commonly required documents include:

- Valid passport or national ID: Non-residents need to present a valid government-issued photo ID, typically a passport, as primary identification.

- Proof of address: This is necessary to establish the applicant’s non-resident status. Proof can come in the form of a utility bill, bank statement, or lease agreement showing a current address.

- Power of attorney (if applicable): Non-residents using a fiscal representative will often need to grant them power of attorney, authorizing the representative to handle the application process and receive any tax correspondence on their behalf.

These documents should be clear and current, with translations if necessary. Non-residents are advised to ensure accuracy in all personal information to avoid delays in processing.

How to apply for a NIF online with E-Residence

- Access the E-Residence website: Begin by navigating to the official E-Residence website, which specializes in online NIF applications. Ensure you’re on the correct page to start the NIF application process.

- Complete the application form: E-Residence provides a simple, guided form where you’ll input personal details, such as your full name, nationality, passport number, and contact information. This ensures the Portuguese tax authorities can accurately process your request.

- Upload necessary documents: You’ll need to upload scans of your passport and proof of address. These documents verify your identity and establish your non-resident status. If applicable, upload a power of attorney if you’re designating E-Residence or another representative to manage the process for you.

- Submit payment for processing: E-Residence charges a service fee, generally more cost-effective than traditional in-person services or hiring a lawyer directly. Payment can be made through various secure online options.

- Wait for confirmation: Once submitted, E-Residence handles the processing with Portuguese tax authorities. You’ll receive your NIF via email, typically within a few days. Processing times may vary, but this online route is generally faster and more convenient than in-person applications.

Advantages of using E-Residence’s online service

- Convenience and accessibility: Applying online through E-Residence removes the need for in-person visits to Portuguese tax offices, making it ideal for applicants living abroad who cannot travel easily. This approach saves both time and logistical costs.

- Time efficiency: E-Residence’s dedicated team manages the application process on your behalf, significantly reducing waiting periods typically associated with in-person applications, especially in major cities where tax offices often have long lines.

- Comprehensive support and guidance: E-Residence offers expert guidance at every step, ensuring all documentation is correctly prepared and submitted. This support minimizes the risk of errors that could delay approval, making the process smoother for first-time applicants unfamiliar with Portuguese requirements.

- Cost-effective solution: Compared to hiring an attorney or representative to handle the NIF process independently, E-Residence provides a competitively priced alternative, streamlining expenses while offering reliable service.

Using E-Residence’s online NIF application service is a practical choice for non-residents who need quick, efficient access to Portugal’s tax system without the complications of in-person appointments or extensive paperwork.

Required documents for online NIF application

Passport or ID

A valid government-issued photo ID, such as a passport or EU national ID card, is essential for all non-residents applying for a NIF in Portugal. This document verifies your identity and nationality, allowing Portuguese authorities to confirm your status as a non-resident. Ensure that the scanned image of your ID is clear and legible to avoid any delays in the processing of your application.

Proof of address and other documentation

Non-residents are also required to provide proof of their current address outside Portugal. This can be presented as a bank statement, utility bill, or driver’s license, generally issued within the past three months. The document should display the applicant’s name and address, clearly verifying the non-resident status. Documents in a language other than English or Portuguese may need to be translated for clarity, especially if requested by the Portuguese Tax Authority.

These two documents—ID and proof of address—are typically the only materials needed for an online NIF application, making the process straightforward and accessible for applicants worldwide.

Benefits of getting your NIF online with E-Residence

Fast processing times

One of the key advantages of applying for a NIF through E-Residence is the quick turnaround time. Unlike traditional in-person applications, which can be delayed due to high demand at local tax offices, E-Residence’s online service typically issues a NIF within three days, making it one of the fastest methods available. This is especially beneficial for non-residents on tight schedules or those needing a NIF quickly to initiate other processes, such as opening a bank account or securing property in Portugal.

No need to travel to Portugal

E-Residence allows applicants to complete the entire NIF application remotely, eliminating the need to visit Portugal or a Portuguese tax office. This convenience is particularly advantageous for non-EU residents, who would otherwise need a fiscal representative in Portugal to apply in person. With E-Residence, non-residents save on travel costs and logistical hassles, handling the process entirely online from the comfort of their home. This approach also reduces the complexity of appointing a fiscal representative and managing in-person paperwork, making it a seamless option for those abroad.

Frequently Asked Questions

Do I need a fiscal representative to get a NIF as a non-resident?

What documents do I need to apply for a NIF online?

Is the NIF application process entirely online?

What happens if I need to update my address or change my fiscal representative later?

Last updated: 28.10.2024