If you’re heading to Spain as a student, two things are going to follow you like shadows: your NIE paperwork and questions about taxes. They might seem confusing at first, but trust us—once you break them down, they’re manageable. The NIE (Número de Identidad de Extranjero) is simply your ID number in Spain’s system, while your tax status depends on how long you stay and what you earn. Let’s untangle this mess together.

EU vs Non-EU Student NIE Application Comparison

Understanding the NIE: Your Gateway to Spanish Life

The NIE—Foreigner Identification Number—is what makes you exist in Spain’s bureaucratic universe. It’s not a visa, it’s not a residence permit (well, not exactly), and it’s definitely not optional if you’re staying longer than three months. This number follows you for life, even if you leave Spain and return decades later.

Here’s where the confusion often starts: the NIE is a number, but the document proving it varies depending on whether you’re an EU or non-EU citizen. EU students get a paper certificate with the number printed on it. Non-EU students receive a plastic TIE card—the Tarjeta de Identidad de Extranjero—that functions as both your residence permit and your NIE proof. Both do the same job; they just look different.

You’ll need your NIE for pretty much everything in Spain that involves paperwork: opening a Spanish bank account, signing a rental contract, getting your phone line activated, purchasing car insurance, enrolling in university courses that require registration, working legally, paying taxes (if applicable), and accessing public healthcare services. It’s the administrative key that opens every door.

Why NIE Matters for Different Student Groups

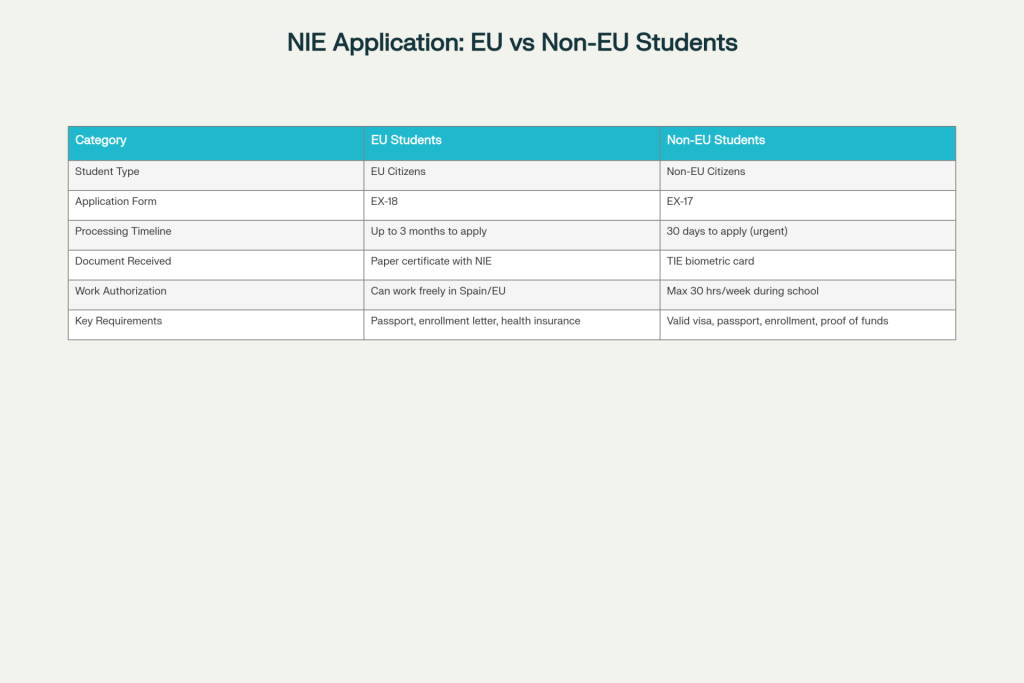

The student NIE application process isn’t one-size-fits-all. Spain treats EU and non-EU students differently, which affects how quickly you can get your NIE and what legal benefits come with it.

For EU students, the process is relatively forgiving. You have three months from arrival to apply, which gives you breathing room to settle in and figure out the Spanish administrative system. You’ll complete form EX-18, gather some basic documents, and walk away with your NIE certificate. Your fundamental rights to study, work, and move around the EU are already guaranteed by EU treaties, so the NIE is mainly for administrative convenience.

For non-EU students, the timeline is much tighter. You have only 30 days from entry into Spain to apply for your NIE—missing this deadline can put you in violation of residence laws. You’ll use form EX-17 and receive your TIE card, which serves double duty as both residence permit and NIE proof. Non-EU students also need to navigate work authorization separately, even if they’re allowed to work part-time.

The 183-Day Rule: When You Become a Tax Resident

Here’s where most students get tripped up: having a NIE doesn’t make you a tax resident of Spain. Let’s make this crystal clear—NIE and tax residency are two completely separate things.

Spain uses a simple rule to determine tax residency: spend more than 183 days in the country during any calendar year, and boom—you’re classified as a tax resident for that year. Those days don’t need to be consecutive, either. If you arrive in September, stay through December, leave for Christmas break, come back in January, and stay through June—Spain’s tax authorities will count all those days added together. If you hit 183, they consider you a tax resident for the entire year.

The practical impact: as a tax resident, Spain expects you to report and pay taxes on your worldwide income. That includes earnings from summer jobs in your home country, investment dividends, rental income, side gigs—everything. If you’re a non-resident (under 183 days), Spain only cares about income you earned within Spain.

But here’s the silver lining for most students: if you’re not working in Spain and you’re living off family support, scholarships, or savings, you probably have zero taxable income to report anyway. The tax obligation only kicks in when there’s actual income to tax.

Tax Brackets and What They Mean for You

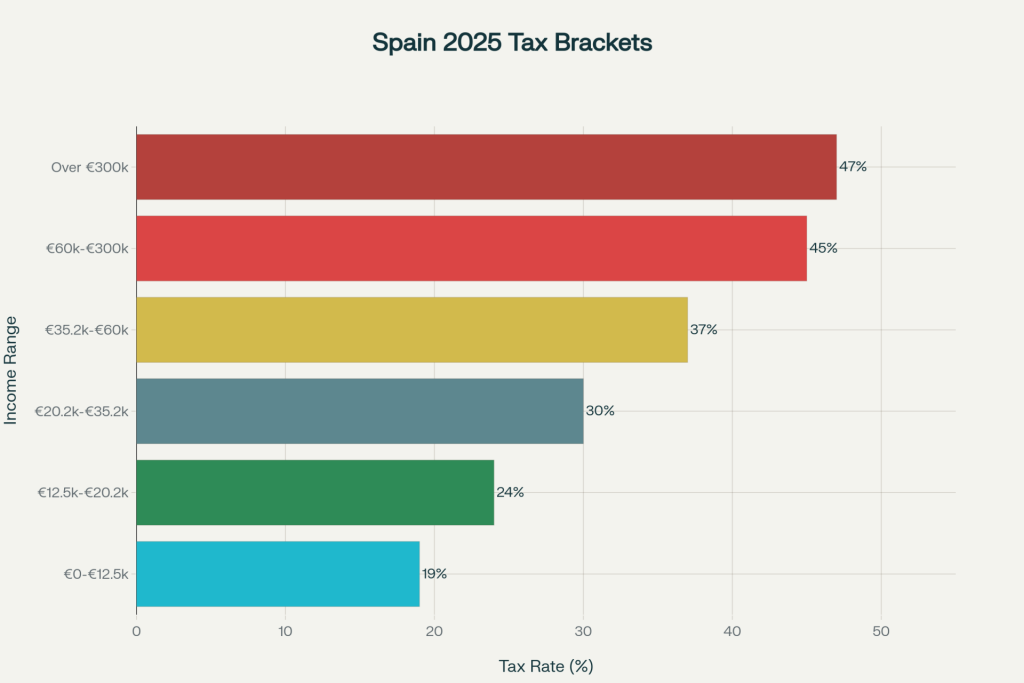

If you do end up working in Spain, knowing the tax rates matters. Spain’s tax system is progressive, meaning wealthier earners pay higher percentage rates. For 2025, here’s the breakdown:

Spain 2025 Individual Income Tax Brackets

A typical part-time student earning €500-800 per month falls into the lowest bracket at 19%. So if you earn €600 per month for eight months (€4,800 total), you’d owe roughly 19% of that, or about €912 in taxes for the year.

But don’t forget: Spain has tax treaties with most countries to prevent double taxation. For example, under the US-Spain treaty, students and trainees can receive scholarships and stipends tax-free for up to five years if the money comes from abroad. Similar provisions exist for students from most European countries, Canada, and Australia.

Making Sense of Work Authorization With Your NIE

Your NIE is necessary for working legally in Spain, but it’s not sufficient by itself—you need actual work authorization too.

EU students have it easiest. You can work anywhere in Spain at any time because EU law grants you freedom of movement and employment. The NIE is mainly needed for your employer’s administrative purposes and for tax/social security registration.

Non-EU students face more restrictions. Typically, you’re allowed to work up to 30 hours per week during the school year, and full-time only during official university breaks (maximum three consecutive months). Your employer must request work authorization from the immigration office using form EX-12. They’ll verify that working won’t interfere with your studies and that the position is legitimate.

The work authorization process usually takes 2-4 weeks. You’ll need a signed employment contract, your passport, your student visa documentation, and your NIE number (or NIE certificate if you just got it). Here’s the critical part: you cannot start working before getting approval, even if you have a job offer.

Part-time earnings are fully taxable. Whether it’s teaching English, working at a café, or doing a university internship, that income is subject to Spanish tax. But if you’re earning less than €22,000 annually from a single employer, you might be exempt from filing a full tax return. Most student part-time jobs fall well below this threshold.

| Student Type | Work Hours | Authorization Needed | Tax Rate |

|---|---|---|---|

| EU Students | Unlimited | No permit needed | Income-dependent |

| Non-EU Students | Up to 30 hrs/week | Work permit (EX-12) | 19-24% flat or progressive |

| Erasmus (grants) | Varies | Depends on grant type | Often exempt |

The EX-15 Students Form and Application Process

Let’s get practical. Here’s what the application process actually involves:

Step 1: Book Your Appointment

Everything starts with cita previa (appointment booking) through the Spanish National Police website. This is crucial because walk-ins typically aren’t allowed at police stations. Appointments can be scarce, especially in major cities during enrollment season, so book yours as early as possible—sometimes weeks in advance.

Step 2: Prepare Your Documents

Gather originals and copies of everything on your checklist:

- Completed and signed EX-15 form (or EX-17/EX-18 depending on your status)

- Valid passport with copies of all pages

- Acceptance letter or enrollment certificate from your school

- Proof of payment (Modelo 790 receipt showing you paid the €9-12 fee)

- Proof of address in Spain (utility bill, rental contract, or empadronamiento)

- Health insurance documentation

- Recent passport-style photos (requirements vary by office)

Step 3: Pay the Fee

Complete and pay Modelo 790 Código 012, which costs around €9-12. You can do this online through the Spanish National Police website or at most banks. Keep your receipt—you’ll need it for your appointment.

Step 4: Attend Your Appointment

Show up with everything in original and copy form. Bring extra copies just in case. The officer will review your documents, verify that everything matches, ask a few questions about why you need the NIE and where you’ll be studying. The entire appointment usually takes 15-30 minutes.

Step 5: Receive Your NIE

Depending on the office, you might get your NIE number immediately or within a few days to two weeks. Some offices issue it on the spot, others require you to return for collection or send it by mail.

The Hidden Benefits of Having Your NIE Early

Once you’ve got your NIE, life becomes significantly easier. You can finally open a Spanish bank account without jumping through hoops. This is huge if you’re receiving payments for work, travel reimbursements, or transfers from family back home.

Your NIE is your ticket to getting a phone contract instead of being stuck with expensive tourist SIM cards. Landlords require it before signing rental agreements. If you’re planning to buy a used bike or scooter to get around, registration requires your NIE. Even mundane things like gym memberships or library access at your university often demand showing your NIE.

For Erasmus students specifically, having your NIE early simplifies everything related to exchange programs. Your NIE serves as proof of your status for university records, travel within Europe, and banking needs.

“The NIE is necessary to register for public health services, education, mobile phone service, Internet, or even to obtain a digital certificate. We recommend applying for your NIE before arriving in Spain or as soon as possible after arrival.”

Renewal and Long-Term Planning

Here’s something many first-year students forget: your NIE documentation has expiration dates. Your TIE card or residence permit expires, usually after a few years. The NIE number itself is permanent, but the document proving it needs renewal.

Start planning your renewal 60 days before expiration—don’t wait until the last minute. You’ll book another cita previa, gather updated enrollment certificates proving you’re still a full-time student, provide proof of continued financial support, show valid health insurance, and pay another small fee (typically around €7-10). The process is essentially the same as initial application, just with current documentation.

If you need to travel while your renewal is being processed, ask for an autorización de regreso (return authorization certificate) from the police office. This allows you to leave Spain during the renewal period and return without legal complications.

Common Pitfalls and How to Avoid Them

Don’t wait to book your appointment. Seriously. In Madrid and Barcelona, available slots can vanish weeks in advance, especially at the start of the academic year. Book yours as soon as you’re registered at your university.

Don’t assume your visa automatically makes you legal. Non-EU students: having a visa stamp in your passport doesn’t mean you’re done. You must convert that visa into a TIE card within 30 days—it’s not optional.

Don’t eyeball the 183-day rule. If you’re hovering near six months in Spain, track your days meticulously. Spain’s tax authorities cross-reference passport stamps and flight records. A few extra days could shift your tax classification for the entire year.

Don’t work “off the books.” Cash-in-hand, under-the-table work might seem convenient, but it’s illegal and risks deportation. Spain enforces labor laws, and employers face serious fines for hiring workers without authorization.

Don’t let your documents expire. Set a phone reminder for 60 days before your NIE or residence permit expires. Gaps in legal status cause massive headaches.

After Graduation: Your NIE Keeps Working for You

Your NIE doesn’t evaporate when you graduate—it’s actually your bridge to staying in Spain if you want. Spain offers special job-search visas allowing recent graduates to stay up to 12 months to look for employment.

You can apply for this job-search visa 60 days before your student NIE expires or up to 90 days after expiration. During that year, you can interview, network, and accept job offers without leaving Spain. Once you land a position, you can transition to a work permit without restarting your residence application from abroad.

FAQ

Q: Is the NIE the same as the TIE?

Not exactly. The NIE is your number. The TIE is the card that holds the NIE (for non-EU students) or proves the NIE (for EU students who get a certificate instead). They’re related but different—NIE is the identifier, TIE is the document.

Q: Will getting my NIE automatically make me a tax resident?

No. The NIE is purely administrative. Tax residency depends on spending more than 183 days in Spain during a calendar year. You could have a NIE for years and never be a tax resident if you don’t meet the day threshold.

Q: Can I work part-time with just a student visa and NIE?

EU students can work freely once they have their NIE. Non-EU students can work up to 30 hours per week if their employer requests work authorization (form EX-12). Simply having the visa and NIE isn’t sufficient—your employer must get official permission first.

Q: What if I don’t pick up my NIE by the date promised?

Contact the police office that issued it. Sometimes documents are held for a limited time before being returned to the application file. In worst case, you may need to reapply. Don’t let this happen—follow up when promised.

Q: Do Erasmus students need to apply for NIE in Spain or can we apply from our home country?

Erasmus students must apply in Spain after arrival. You cannot apply through a Spanish consulate in your home country as a student. This is why it’s critical to apply within the first few weeks of arrival.

Q: If I work part-time in Spain during my studies, do I owe taxes to both Spain and my home country?

Potentially, yes—but the double taxation treaty between Spain and your country should prevent paying tax twice on the same income. Each country has rules about when income is taxable. Consult a tax professional about your specific situation to be safe.

Q: What happens if I overstay and accidentally become a tax resident when I didn’t plan to?

If you cross 183 days in a calendar year, you’re classified as a tax resident for that entire year. You’d need to file a Spanish tax return and declare worldwide income. However, if you have no taxable income (just living off savings or scholarships), there’s nothing to tax. If you earned income, the double taxation treaty protects you from being taxed twice.

Official ResourcesOfficial Resources

Spanish Ministry of Inclusion, Social Security and Migration:

https://www.inclusion.gob.es

Spanish National Police (Policía Nacional):

https://www.policia.es

Spanish Tax Agency (Agencia Tributaria):

https://www.agenciatributaria.gob.es

Last updated: 01.12.2025