Table of contents

Who must use the Portuguese NIF Number?

Getting a NIF is vital for everyone who resides in Portugal. But it is going to be even more important if your daily activities are connected with legal stuff such as getting property or opening an account in the bank. Also, if you would like to receive a loan or sign a phone contract, you will be obliged to have a NIF.

Those who do not have a NIF won’t have any issues speaking of the Portugal law but nevertheless, there are a lot of situations where you won’t be able to deal without it.

How to get a NIF Number in Portugal online

Step 1: Determine your residency status

Identify if you are an EU/EEA resident or a non-EU resident, as the process differs.

Step 2: Choose how to apply

Non-EU Residents: Apply in person with a tax representative or have the representative handle the process online. EU/EEA Residents: Apply in person at Finanças or via email.Step 3: Gather necessary documents

- Passport or ID card: Required for all applicants.

- Proof of Residency:

- In Portugal: Provide a utility bill or rental agreement.

- From abroad: Provide a recent bank statement (within the last three months).

Step 4: Visit the Finanças office (if applying in person)

Take your documents to the nearest government office for in-person applications.

Step 5: Submit documents and obtain your NIF

Hand over your documents to receive your NIF, which will be issued promptly and won’t expire.

Where can I use my Portuguese NIF Number?

NIF Portugal is something you have to use if you would like to be involved in the following stuff:

- Opening an account in the bank;

- Being a student of the local university;

- Buying or selling the property of any kind;

- Paying taxes in this country;

- Obtaining payments from social security;

- Inheriting assets in Portugal;

- Buying a car and an application of a driving license;

- Signing a contract for a mortgage or a mobile phone;

- Setting up utilities, etc.

So, this list is proof of the fact that it is really hard to deal without a NIF in Portugal. But don’t worry! It is not that difficult to receive it if you know what to do!

What is the role of NIF Number through Portugal Golden Visa process?

The matter is that in order to proceed with the transactions vital for obtaining a Golden Visa, this number has to be applied too. so, in case you are an investor who plans to apply for a Golden Visa, you can request a NIF at the same time.

Do not worry if you are a non-EU/EEA resident as long as you can apply for the program and a NIF too.

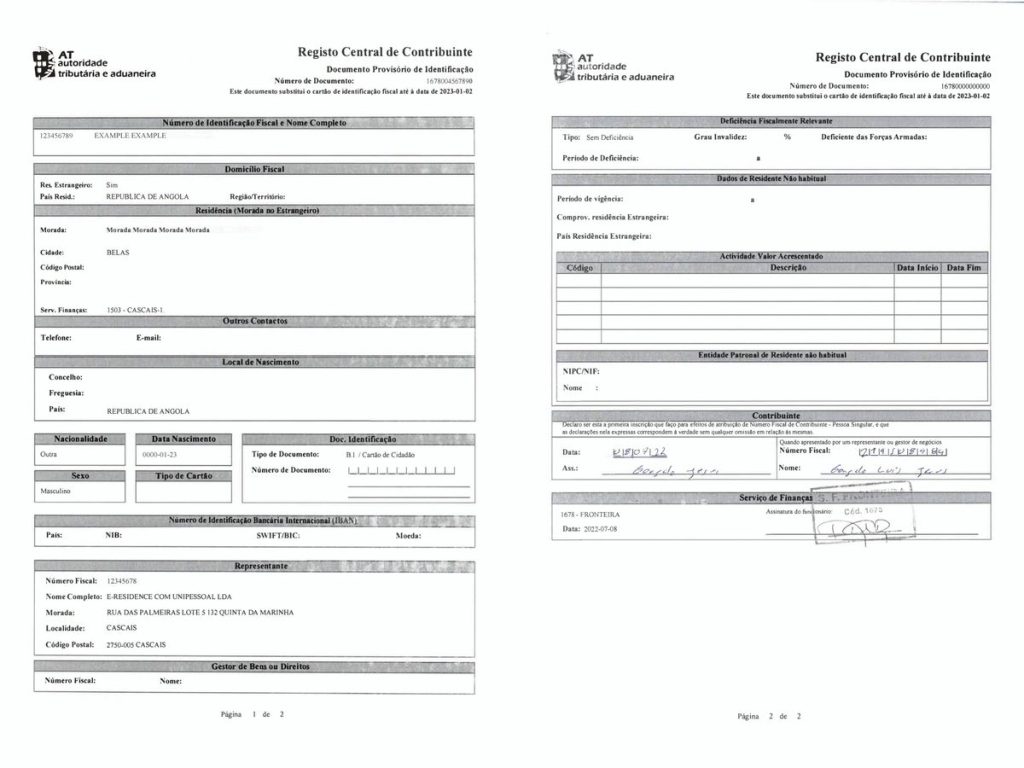

How to get NIF with E-residence online?

Well, we have already mentioned that you can get involved in receiving a NIF on your own but also, it is a great idea to stick to professional assistance. In this case, you can get NIF online too.

It is going to be extremely easy and quick. Note that you will have to provide just two documents which are a scan of the international passport and proof of address (enclose your utility bill or a bank statement).

Your NIF will be sent to the email you will indicate in the PDF format. Also, E-residence is ready to offer a 100% money-back guarantee! In most cases, the process will be completed within three days (certainly, there might be some exceptions).

So, if you wonder how to get a NIF in Portugal, choose the most rational variant and stick to it as long as time is the most precious resource. And you will save it by cooperating with the professionals!

FAQ

Do I need a tax representative to get a NIF?

Non-EU residents: Yes, a tax representative is mandatory.

EU/EEA residents: You can apply directly without a representative.

What documents do I need to apply for a NIF?

A valid passport or ID card, and proof of residency (utility bill, rental agreement, or a bank statement dated within the last three months).

Can I use my NIF outside of Portugal?

The NIF is primarily for use within Portugal, but it's essential for any financial or legal activities tied to Portuguese transactions.

Does the NIF number expire?

No, the NIF number does not expire once issued.

Can I apply for a NIF if I’m not living in Portugal?

Yes, non-residents can apply through a tax representative from abroad.