Introduction

If you’ve recently moved to Spain — or you’re just planning your relocation — one of the first practical steps will be opening a local bank account.

It may seem bureaucratic, but in reality, it’s easier than most people expect.

Having a Spanish account makes everyday life simpler: paying rent, handling bills, receiving payments, or even shopping online without extra currency fees.

And here’s the good news — you don’t always need a Spanish ID (NIE) to start.

In this 2025 guide, we’ll walk you through how foreigners can open an account step by step: what documents are required, which banks are easiest to work with, and how long the whole process takes.

If you’re still preparing your paperwork or haven’t applied for your NIE yet, check our detailed breakdown of Spanish bank account options for foreigners.

Why You Need a Bank Account in Spain (2025 Edition)

If you’re planning to spend more than a few weeks in Spain — whether for work, study, or property ownership — having a local bank account isn’t just a formality. It’s something that will make your everyday routine much smoother.

Here’s why it matters

- Rent and daily bills. Most landlords and utility companies in Spain prefer SEPA direct debits. They’ll ask for your Spanish IBAN to set up payments automatically.

- Receiving income. Employers, clients, and even government institutions often refuse to transfer money to a foreign account. With a local one, you’ll avoid delays and currency conversion costs.

- Lower transaction fees. Paying with an international card may incur an additional 2– 3% per transaction. A Spanish account saves you that unnecessary expense.

- Property deals and notary payments. If you’re buying or selling real estate, the transaction typically requires a Spanish account for transparency and legal compliance.

- Residency and visa paperwork. Many visa applications — including those for nomads, investors, or students — require proof of a Spanish bank account as part of the process.

Having your own IBAN also simplifies small but essential tasks, such as setting up internet or gym memberships, paying road tolls, or linking your card to digital wallets like Bizum, Apple Pay, or Google Pay.

Expert tip: If you’re not planning to live in Spain full-time, consider starting with a digital bank such as N26 or Revolut. These options are recognized locally and are perfect for managing your finances while you’re still settling in.

Resident vs. Non-Resident Bank Accounts in Spain

Before opening your account, it’s essential to understand which category you fall into — resident or non-resident.

Banks in Spain treat these two types very differently, especially when it comes to verification and fees.

Key Differences

| Criteria | Resident Account | Non-Resident Account |

| Who can apply | Spanish citizens and legal residents with a valid NIE/TIE | Foreigners without Spanish residency (tourists, digital nomads, property buyers) |

| Required ID | Passport + NIE/TIE card | Passport + Non-Resident Certificate (Certificado de No Residente) |

| Verification process | Usually in-person at the branch | Often requires a visit to the branch, sometimes police station for certificate |

| Maintenance fees | Usually lower or waived with salary deposit | Higher monthly fees (8–15 € on average) |

| Account activation time | 2–5 business days | 1–3 weeks depending on certificate issue time |

| Online banking access | Full access and mobile app | Available, but sometimes limited until certificate is confirmed |

| Best for | Long-term residents, employees, families | Short-term visitors, property owners, freelancers, nomads |

Requirements and Documents Checklist

To open a Spanish bank account, you’ll need to prepare a small but specific set of documents.

The list of required documents depends on whether you’re applying as a resident or a non-resident, but in most cases, banks request the same basic paperwork.

Basic Documents (for everyone)

- Valid passport (original, not a copy).

- Proof of address — utility bill, rental agreement, or hotel booking (in English or Spanish).

- Proof of income or employment — recent payslip, tax declaration, or employer letter.

- Initial deposit — usually €100–€300 to activate the account.

Extra Documents for Non-Residents

- Non-Resident Certificate (Certificado de No Residente) — issued by the police station or requested by the bank on your behalf.

- Tax Identification Number from your home country — for example, SSN (USA), NIN (UK), or TIN.

- Proof of purpose — for example, a property purchase contract, rental agreement, or relocation plan (some banks may ask for this).

Important: The Non-Resident Certificate is valid for only 3 months. After that, banks may request you to renew it if you stay longer without becoming a resident.

Opening a Bank Account in Spain Without a NIE

One of the most common questions from newcomers is whether it’s possible to open a bank account in Spain without having a Número de Identificación de Extranjero (NIE).

The short answer is yes, it’s possible — but only with specific banks and with some limitations.

How It Works

Most major banks in Spain require a NIE for complete identification, but a few offer “non-resident” or “foreigner-friendly” accounts that accept just your passport and proof of income.

The bank will usually apply for a Non-Resident Certificate on your behalf — this replaces the NIE in their system for compliance purposes.

This process takes about 7–10 business days, during which your account may be partially active (you can receive deposits, but card activation waits until complete verification).

Banks That Allow Account Opening Without a NIE

| Bank | Can Open Without NIE? | Verification Method | Account Type |

| Santander | ✅ Yes | Bank requests Non-Resident Certificate automatically | Santander Mundo Account |

| BBVA | ✅ Yes | Passport + proof of address | Cuenta Online BBVA |

| CaixaBank | ⚠️ Limited | May require NIE within 3 months | HolaBank Account |

| Sabadell | ✅ Yes | Passport + police-issued certificate | Non-Resident Account |

| N26 | ✅ Yes (online) | Selfie + ID scan | Digital account with ES IBAN |

| Revolut | ✅ Yes (online) | ID verification only | Digital account, EU IBAN |

Why Getting a NIE Still Matters

While opening an account without a NIE is possible, it’s always better to have one — especially if you plan to live, work, or invest in Spain.

With a NIE, your banking options expand, verification becomes faster, and fees are often lower.

It’s also required for renting property, paying taxes, or signing official documents.

You can get your NIE completely online through a verified digital service — no need to visit Spain in person:

👉 Apply for your NIE online here

Best Banks for Foreigners in Spain (2025 Edition)

Spain has dozens of banks, but not all of them are equally friendly to newcomers or non-residents.

Some require a Spanish address or a NIE right away, while others make the onboarding process smoother for foreigners.

Below is a comparison of the most popular and practical options in 2025.

Top Banks for Non-Residents and Expats

| Bank | Main Features | Monthly Fee | Online Opening | Languages Supported |

| Santander Mundo Account | Non-resident friendly, branch network, debit & credit cards, international transfers | €10 (can be waived) | ❌ In-branch only | English, Spanish |

| BBVA Online Account | Fully digital, simple onboarding, low fees, solid app | €0 | ✅ Yes | English, Spanish |

| CaixaBank HolaBank | Tailored for foreigners, multilingual support, mortgage-friendly | €15 | ❌ In-branch only | English, French, German, Russian |

| Banco Sabadell Non-Resident Account | Flexible ID policy, easy property transfers, international coverage | €10 | ❌ In-branch only | English, Spanish |

| N26 Spain | 100% digital, quick verification, ES IBAN, mobile app | €0–€9.90 (depends on plan) | ✅ Yes | English, Spanish, German |

| Revolut EU IBAN | Instant setup, multi-currency, no paperwork | €0–€13.99 (depends on plan) | ✅ Yes | 20+ languages |

Pro tip: If your goal is long-term relocation or property ownership, start with a digital account (N26 or Revolut) to manage transfers, then open a traditional account (Santander or Sabadell) once you receive your NIE.

Choosing the Right Bank for Your Needs

- For everyday use → BBVA or N26

- For property or mortgage → Sabadell or CaixaBank

- For remote setup → Revolut or N26

- For bilingual support and physical branches → Santander or CaixaBank

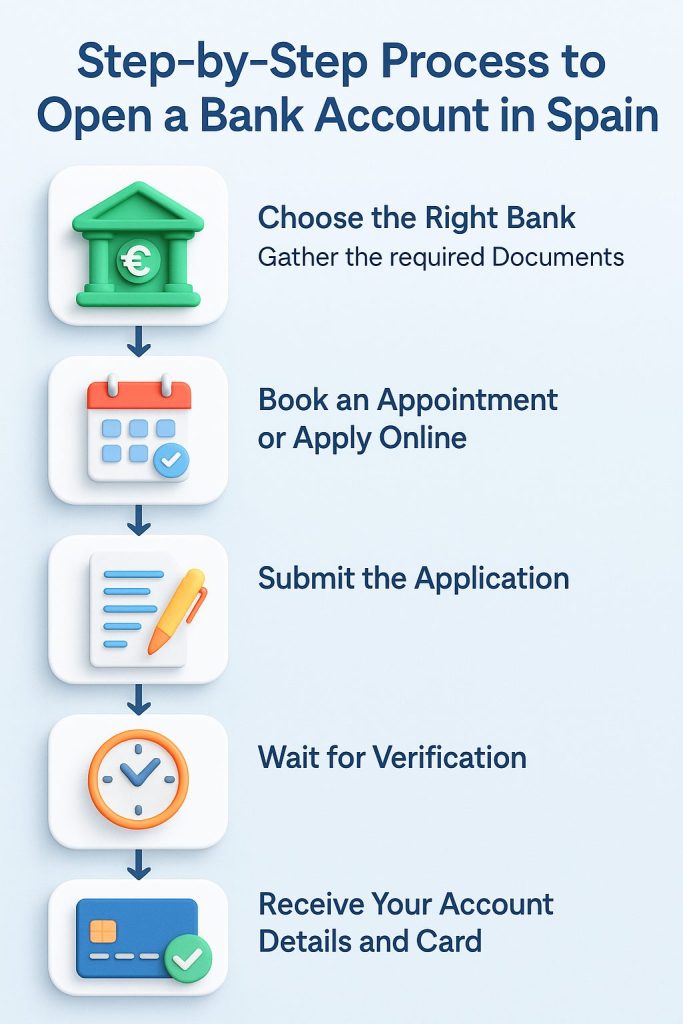

Step-by-Step: How to Open a Bank Account in Spain

The process is quite straightforward once you know the steps.

Here’s how it usually goes — whether you’re in Spain or applying remotely.

1. Choose the Right Bank

Start by selecting a bank that fits your situation — traditional or digital.

If you’re new to Spain and don’t have a NIE yet, consider opening a BBVA, N26, or Santander Mundo Account.

2. Gather the Required Documents

Have your passport, proof of address, and proof of income ready.

If the bank requires it, also get a Non-Resident Certificate (valid for 3 months).

You can find the full list in the section above.

3. Book an Appointment or Apply Online

Most banks need an in-person appointment for identity verification.

If you choose a digital bank like N26 or Revolut, everything is done online — just upload your ID and take a selfie.

4. Submit the Application

At the branch or online, the bank will verify your documents and ask basic questions about the purpose of the account (salary, property, etc.).

This process usually takes 30–60 minutes.

5. Wait for Verification

If all documents are accepted, your account is opened immediately or within a few days.

If a Non-Resident Certificate is needed, activation can take up to 10 business days.

6. Receive Your Account Details and Card

Once your account is active, you’ll get your IBAN, debit card, and access to online banking.

Most banks also allow you to link your card to Apple Pay or Google Pay instantly.

Pro tip: Keep digital copies of all submitted documents for future reference. Some banks may ask for re-verification after three months, especially if your status changes to resident.

Fees, Taxes, and Money Transfers

Spanish banks are reliable but rarely free, especially for non-residents.

Before opening an account, it’s smart to understand the typical costs and how to minimize them.

1. Monthly Maintenance Fees

Most banks charge between €8 and € 15 per month for non-resident accounts.

However, these fees can often be waived if you:

- Set up a regular income deposit (for example, your salary or pension)

- Maintain a minimum balance (usually €1,000–€2,000)

- Use the bank’s debit card at least once a month.

Pro tip: BBVA and N26 both offer zero-fee accounts for regular users, which makes them ideal for digital nomads and freelancers.

2. Transfer Fees

International transfers within the EU (SEPA) are typically free or incur a fee of under €1.

Transfers outside the EU cost €5–€20, depending on the destination and currency.

To avoid hidden exchange markups, consider using fintechs like Wise or Revolut, as they connect seamlessly with Spanish accounts.

3. ATM Withdrawals

Withdrawals from your own bank’s ATM are free.

Using another bank’s machine incurs an additional fee of €2–€5 per withdrawal, so check for network partners before traveling.

4. Tax Considerations

Even if you’re not a Spanish tax resident, banks are required to report your account activity under EU anti-money laundering regulations.

You won’t pay taxes just for having a bank account — only on income generated within Spain.

However, if you become a tax resident, your worldwide income may become taxable.

Note: If you plan to stay longer than six months, it’s worth consulting a local accountant about your fiscal residency status and reporting obligations.

Common Issues and How to Solve Them

Even if you come prepared, opening a bank account in Spain can sometimes take longer than expected. Here are the most common issues foreigners face — and how to fix them fast.

1. Bank Refuses to Open an Account

Some branches may say they only serve residents. Don’t take it personally — it often depends on the specific office or employee.

✅ Solution: Visit a different branch or city. Larger branches (especially in Madrid, Barcelona, or Malaga) usually handle non-resident requests more smoothly. You can also try BBVA Online or Santander Mundo Account, which accept non-residents more easily.

2. Long Verification Times

The Non-Resident Certificate can take up to 10 working days if requested through the bank.

✅ Solution: Apply for it yourself at the local police station — it’s usually ready in 2–3 days. Please bring your passport, a completed EX-15 form, and proof of address.

3. Account Temporarily Frozen

If your status changes (for example, you become a resident or your certificate expires), the bank might temporarily freeze your account.

✅ Solution: Update your documents immediately — bring your new NIE or certificate to the branch. It’s a routine check required by Spanish law.

4. Unexpected Fees

Some banks charge “maintenance” or “card issuance” fees after the first few months.

✅ Solution: Always ask the bank to provide a written fee schedule (tarifas bancarias). Digital banks like N26 and Revolut clearly display all fees upfront and in English.

5. Online Access Issues

Some banks require in-branch activation of online banking or mobile apps, which can be confusing.

✅ Solution: Bring your passport and contract to the branch; activation takes 5 minutes.

For digital accounts, check your spam folder for the activation link — that’s a common mistake.

Pro tip: Always keep copies of your bank contract, account number (IBAN), and official correspondence. It’ll save you time if you ever switch banks or need to verify payments later.

Digital and Online Banking Options in Spain (2025)

In 2025, digital banking in Spain is booming — especially for foreigners and non-residents.

Modern fintech solutions enable the opening of a Spanish IBAN account in minutes, often without requiring a visit to a branch or submitting extensive paperwork.

1. N26 (Spain)

A German digital bank officially operating in Spain, offering ES IBANs and full English support.

You can open an account in 10 minutes with just your passport and a selfie.

- ✅ No monthly fees (Standard plan)

- 💳 Instant virtual card

- 🌍 Perfect for freelancers, nomads, and travelers

2. Revolut

An international multi-currency account with EU IBAN and support for 30+ currencies. It’s not a traditional Spanish bank, but widely accepted for payments, subscriptions, and transfers.

- ✅ Fast setup (under 5 minutes)

- 💰 Currency exchange at market rate

- 📱 Excellent mobile app

3. Wise (ex-TransferWise)

Not a bank, but a powerful payment platform with borderless accounts and low-cost transfers. You can receive and hold EUR, USD, and GBP in one place — great for expats managing income from multiple countries.

- ✅ Lowest transfer fees

- 💸 Real exchange rates

- 🧾 Connects easily to Spanish banks

4. bunq

A Dutch neobank is gaining popularity in Spain thanks to its eco-friendly approach and smooth app interface.

- ✅ Open an account in minutes

- 🌱 “Green Card” plan supports reforestation projects

- 💳 Multiple sub-accounts for budgeting

Pro tip: Digital banks are great for everyday use, but they don’t replace traditional banks for property purchases or mortgages.

If you plan long-term relocation, start with N26 or Revolut, and later add a Spanish branch account like Santander or Sabadell for full access to in-country services.

FAQ: Opening a Bank Account in Spain (2025)

1. Can I open a bank account in Spain without living there?

Yes, you can. Many Spanish banks permit non-residents to open accounts remotely or in-branch, provided they present a passport and proof of income. Some even apply for the Non-Resident Certificate on your behalf.

2. Do I need a NIE to open a bank account in Spain?

Not always. Several banks — like BBVA, Santander, or N26 — let you open a non-resident account without an NIE. Still, it’s highly recommended to get one for lower fees and easier verification.

👉 You can apply online here: NIE Online Application

3. How long does it take to open a Spanish bank account?

It usually takes 1–3 weeks, depending on the bank. Digital banks like N26 or Revolut open accounts instantly, while traditional banks need time to process your Non-Resident Certificate.

4. What is the minimum deposit to open an account?

Most banks require a small initial deposit of €100 to €300. Digital banks (N26, Revolut) don’t require any deposit at all.

5. Can I open a Spanish bank account online from abroad?

Yes. Banks like N26, Revolut, and Wise allow full online setup from any country. For traditional banks (Santander, Sabadell), you’ll need to visit a branch at least once.

6. Are there accounts with no monthly fees?

Yes — both BBVA Online Account and N26 Standard offer a €0 monthly fee if you use the card regularly.

7. Can I receive my salary or pension into a non-resident account?

Yes, absolutely. Both local and international transfers work fine. Please ensure the sender uses your Spanish IBAN for SEPA payments.

8. What happens when I become a resident?

You’ll need to update your bank status from non-resident to resident. The bank will request your NIE or TIE card and proof of address — there is no need to open a new account.

9. Do Spanish banks charge for closing an account?

Most banks don’t, but some charge a small fee (€10–€20) if the account is closed within the first 6 months. Always check your contract.

10. Which bank is the easiest for foreigners?

For full flexibility — N26 or BBVA Online. For property and mortgages — Sabadell or CaixaBank HolaBank.

Conclusion: Your Spanish Bank Account, Simplified

Opening a bank account in Spain as a non-resident used to be a hassle — but not anymore.

With modern digital tools, multilingual support, and online verification, the process has become straightforward even for newcomers.

Start by choosing the bank that fits your lifestyle — whether it’s a fully digital option like N26 or Revolut, or a traditional bank such as Santander, Sabadell, or BBVA.

If you’re planning to move to Spain or invest in property, it’s worth applying for your NIE early — it will make your banking and legal paperwork much smoother.

When you’re ready to open your account, follow our simple steps or explore detailed guidance on verified banks and non-resident options here: 👉 Open a Bank Account in Spain with E-Residence

Last updated: 12.11.2025