Planning a move to Spain or investing in Spanish property? Here’s something that trips up almost everyone: getting your NIE doesn’t automatically make you a Spanish tax resident. I’ve seen countless people assume that once they have this magic number, they’re locked into Spanish taxes. Not quite. Understanding how your NIE connects to your tax obligations could save you thousands—or help you avoid serious legal trouble. And if you’re overwhelmed by Spanish bureaucracy, getting your NIE handled professionally might be your smartest first step.

What’s This NIE Thing Anyway?

The NIE (Número de Identificación de Extranjero) is basically your Spanish tax ID. It looks something like X-1234567-L—one letter, seven digits, another letter. That’s it.

Here’s what makes it special: this number is yours forever. Seriously, forever. If you lose your NIE certificate, you’ll get the same number back. Spain uses this to track everything financial you do: opening bank accounts, buying apartments, starting businesses, filing taxes.

But—and this is huge—having an NIE doesn’t flip a switch that makes you a Spanish tax resident. Your tax status depends on your actual situation: where you spend your time, where you make your money, where your family lives.

The NIE Tax Spain Connection Explained

When people say “NIE tax Spain,” they’re talking about how your identification ties into what you owe the Spanish tax office. Yes, your NIE shows up on every single tax form. But the number itself isn’t what determines your tax obligations—your lifestyle choices are.

Resident or Non-Resident: Here’s How Spain Decides

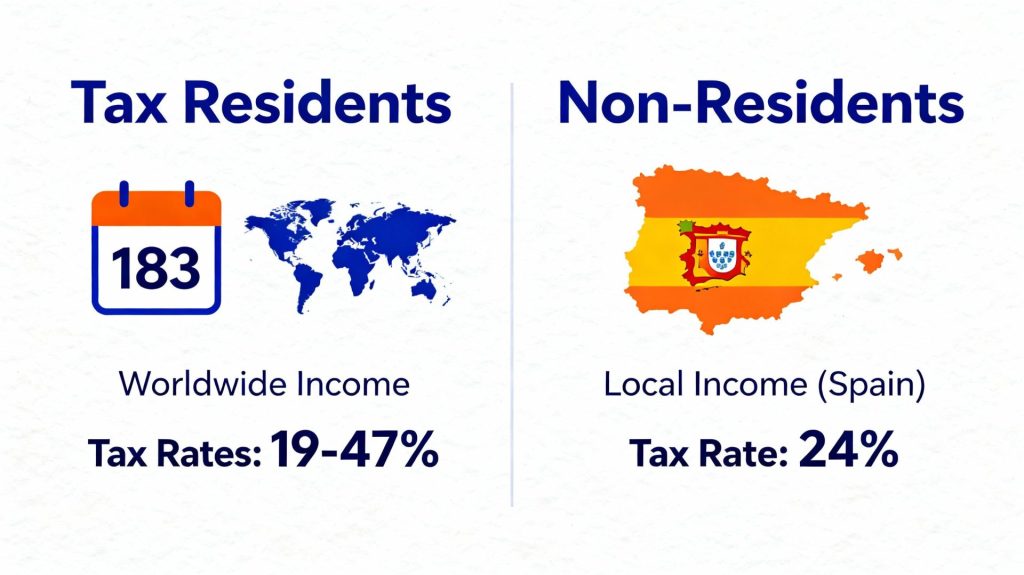

Spain splits foreigners into two tax categories. The rules are night and day different.

What Makes You a Tax Resident?

You become a Spanish tax resident if you hit any of these:

- You’re physically in Spain more than 183 days in a calendar year

- Spain is where your main business or income source sits

- Your spouse and minor children live in Spain (even if you claim residency elsewhere)

Tax residents pay Spanish tax on every euro they earn worldwide. Non-residents only pay Spanish tax on Spanish-sourced income.

Think about it: a British retiree who spends seven months in Málaga? Tax resident. An American who owns a Barcelona flat but visits twice a year? Non-resident.

Breaking Down the Tax Rules

Your NIE Works for Both

Whether you’re a resident or not, you use the same NIE for taxes. Residents typically get a physical TIE card (residence card) with their NIE on it. Non-residents just have the paper document. Same number though.

Real People, Real Situations

The Digital Nomad Trap

Working remotely from Barcelona for your New York employer? Count your days carefully. Hit day 184 and boom—you’re a Spanish tax resident, even without a residence permit. You’ll need to report that US salary to the Spanish Tax Agency.

Property Owners Who Don’t Live There

This is the most common reason foreigners need an NIE. Own a Spanish property but only visit on vacation? You still file yearly tax returns (Modelo 210) as a non-resident. Spain taxes you on something called “imputed income”—basically taxing you as if you’re renting the place to yourself. Your NIE makes this whole process possible.

Business Owners and Investors

Starting a Spanish company or opening investment accounts? Your NIE is required for absolutely everything. Spanish tax officials use this number to track every business transaction. Keep meticulous records—you’ll need them when tax season rolls around.

Getting Your NIE: The Practical Stuff

What Documents You’ll Need

The Spanish National Police requires:

- Form EX-15 (only exists in Spanish—good luck with that)

- Complete passport copy (every single page)

- Justification for needing an NIE (employment contract, property deed, business documentation)

- Modelo 790 fee receipt (around €12)

- Two passport-style photos

How Long Does It Take?

Plan on 5-10 working days for processing, though this varies wildly by location. The official government fee is roughly €12. Hiring a lawyer or gestoría (administrative specialist) will run you an additional €150-300.

Non-Resident Tax Obligations

Non-residents need to stay sharp about their Spanish obligations. Rent out your Valencia apartment for even a single week? That triggers quarterly tax filings. The standard non-resident rate sits at 24% for most income types, dropping to 19% for investment gains.

Double Taxation Treaties: Your Safety Net

Spain maintains tax treaties with over 90 countries. These treaties prevent you from getting hit with full taxes in two places on the same income. When you’re filing in both Spain and your home country, always include your NIE on every document. This helps tax officials from both countries coordinate properly and apply treaty protections correctly.

Common Mistakes That Cost Real Money

People accidentally trigger tax residency by:

- Keeping utility bills in their name all year round

- Enrolling their kids in Spanish schools

- Running businesses from Spain while pretending to live elsewhere

- Not accurately tracking their days spent in Spain

Your NIE appears on all these documents. Spanish tax authorities can easily piece together your actual presence during audits.

Staying Compliant Without the Headache

Track every single day you spend in Spain—especially if you’re dancing around that 183-day line. Find a good Spanish tax advisor (gestor) who understands NIE tax Spain complexities. They’ll help you structure everything legally while keeping you out of trouble.

Digital workers and location-independent people really need to think this through. Some choose full Spanish residency for healthcare and benefits. Others carefully structure their time to remain non-resident. Both approaches work fine—if you plan properly from the start.

The Bottom Line

Your NIE is way more than just an identification number. It’s the cornerstone of your entire tax relationship with Spain. Understanding how this Spanish tax number affects your obligations—regardless of resident status—helps you dodge expensive mistakes. Tax laws shift regularly, so staying current on NIE tax Spain requirements protects your compliance status and your bank account.

FAQ: NIE and Tax Status in Spain

Q: If I get an NIE, am I automatically a Spanish tax resident?

Absolutely not. Your NIE is simply an identification number for Spanish procedures. Tax residency only kicks in when you physically spend 183+ days in Spain or when your main business operations are based there. The Spanish Tax Agency determines residency based on your actual presence and economic connections, not on whether you hold an NIE.

Q: Can I hold an NIE without being a Spanish resident?

Yes, definitely. Plenty of non-residents carry NIEs for specific reasons—purchasing property, inheriting assets, or making investments. Your residency status hinges on days physically spent in Spain and business connections, not on the NIE itself.

Q: What if I exceed 183 days in Spain without declaring tax residency?

You’re looking at penalties, back taxes, and interest charges. Spanish authorities can verify your entry/exit records and demand retroactive tax filings on worldwide income. Always consult a tax professional if you’re approaching this threshold.

Q: How do I prove my tax residency status using my NIE?

Tax residents obtain a fiscal residency certificate (certificado de residencia fiscal) from the Tax Agency, which includes your NIE. Non-residents can get non-resident tax certificates for treaty purposes. Both documents come from the Agencia Tributaria using your Spanish tax number.

Q: Do I update my NIE when my tax status changes?

Your NIE number stays constant forever, regardless of residency status changes. However, you must notify tax authorities when switching from non-resident to resident status (or vice versa) to ensure correct tax treatment moving forward.

Q: Can proper planning legally reduce my Spanish taxes?

Yes, with intelligent planning. Understanding residency regulations, correctly applying double taxation treaties, and timing major financial decisions can all optimize your tax position legally. Always work with qualified tax professionals rather than attempting aggressive strategies that might trigger audits.

Q: Which Spanish tax forms require my NIE?

Your NIE appears on every Spanish tax document: Modelo 100 (resident income tax), Modelo 210 (non-resident income tax), Modelo 720 (foreign assets declaration), property tax bills, wealth tax returns, and all business filings. It’s your universal identifier throughout Spain’s entire tax system.

Last updated: 25.11.2025