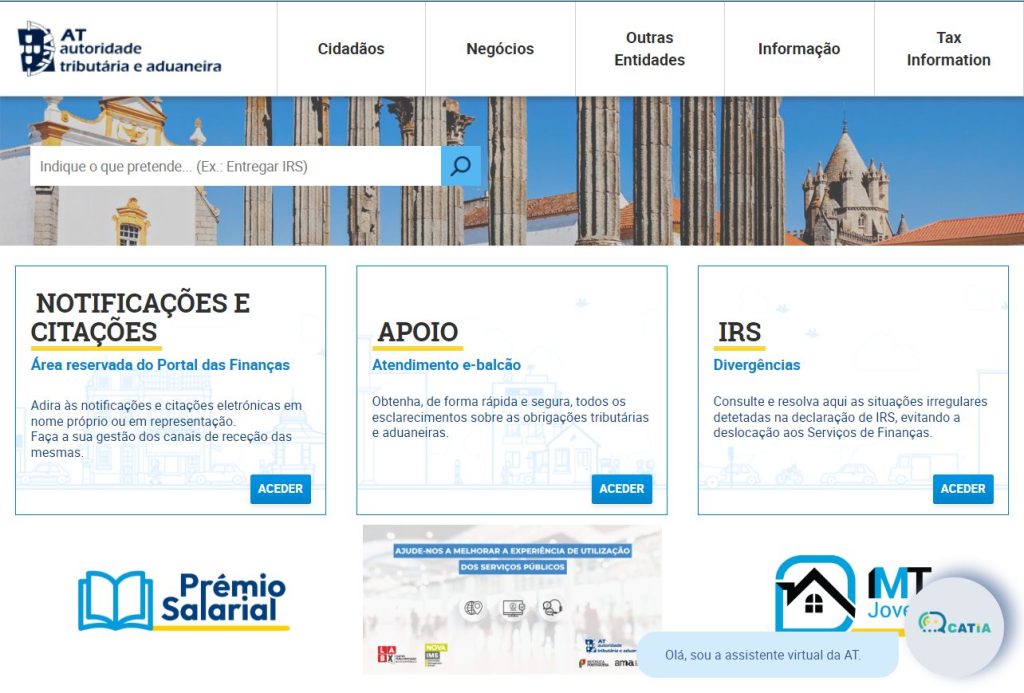

The Portal das Finanças is Portugal’s official online platform for tax-related services, managed by the Portuguese Tax and Customs Authority (AT). It allows both residents and non-residents to manage their fiscal obligations conveniently online. Through this portal, users can access services such as filing tax returns, reviewing tax documents, paying taxes, and managing personal tax information.

To access the portal, individuals need a NIF (Número de Identificação Fiscal), which is the Portuguese Tax Identification Number. This portal is essential for anyone who engages in any financial, property, or employment-related activities in Portugal.

The NIF password is your secure key to accessing the Portal das Finanças and managing your tax matters. Without it, you cannot file tax returns, pay taxes, or access critical financial information. The password is sent by mail after registering for a NIF, ensuring that your access is protected. Once received, this temporary password should be changed for security purposes. It’s essential to update it regularly and safeguard it, as it is linked to your financial data.

Maintaining control over your NIF password is crucial for protecting sensitive personal and financial information. If lost or compromised, immediate action is required to recover or change the password, preventing unauthorized access.

Table of contents

Steps to request your NIF password

Step 1. Registering on the Portal das Finanças

To access the Portal das Finanças, you first need to register as a new user. This is a critical step if you haven’t previously registered for online access. Here’s how to register:

- Visit the Portal das Finanças: Go to the official website portaldasfinancas.gov.pt.

- Click on “Register” (Registar-se): On the homepage, locate the “Registar-se” option in the top-right corner.

- Choose “Registo com NIF”: This option is required for users registering their Taxpayer Identification Number (NIF). You will also need to create a security question to facilitate future password recovery.

Step 2. Completing the NIF registration form

After choosing the registration option, you must complete the NIF registration form with the following information:

- Taxpayer number (NIF): This is your unique tax identification number in Portugal.

- Personal details: You will need to provide personal information such as your full name, email address, phone number, and fiscal address. If you are residing outside Portugal, you must include the address of your fiscal representative.

- Security question: Set a security question, which will be used in case you need to recover or reset your password.

Once the form is filled out and submitted, you will receive confirmation codes via email and SMS for further verification.

Step 3. Verifying contact information

After registration, the system will send you two verification codes: Email confirmation (a code will be sent to the email address provided in the registration form) and SMS confirmation (a second code will be sent to your mobile phone). You will need to confirm both of these codes on the Portal das Finanças to complete the registration process.

Once the verification is complete, you will receive a temporary password by mail at your registered tax address. This temporary password must be changed when you first log in to the portal to ensure security.

Step 4. Mail delivery process (passport delivery)

Once the registration and password request have been completed, the Portuguese Tax Authority (Autoridade Tributária e Aduaneira) sends your temporary password via regular mail (CTT). The password is sent to the tax address you provided during registration. If you have a fiscal representative in Portugal, the password will be sent directly to them. This delivery is crucial for securing your account access, as the Portal das Finanças will not send the password via email for security reasons.

Timeframe for password delivery

The password delivery process typically takes between 5 to 14 business days for domestic addresses in Portugal. However, for international addresses or those using a fiscal representative, the delivery time can extend to 3 to 4 weeks. It’s important to ensure that your tax address is up to date in the tax office’s records to avoid further delays.

Handling delays in receiving the password

If your password does not arrive within the expected timeframe, it is advisable to take the following steps:

- Contact the tax office. Reach out to the Autoridade Tributária e Aduaneira to inquire about the status of your password request. You can do this through their e-balcão service or by visiting a local tax office.

- Check your registered address. Ensure that the tax address registered with the Finanças portal is correct. If your address has changed or contains any errors, this could delay the delivery of your password.

- Consider visiting the tax office in person. If you experience prolonged delays, visiting a local tax office or contacting a fiscal representative may help expedite the process.

By taking these steps, you can ensure you receive your temporary password and gain access to the Portal das Finanças without further complications.

Step 5. First-time login and security

Once you receive your temporary password via mail from the Portuguese tax authority, you can access the Portal das Finanças for the first time. This password allows you to log in to your account and start managing your tax information online. However, this password is only temporary, and for security reasons, it must be changed as soon as possible after your first login.

To log in:

- Go to the Portal das Finanças website and click on “Iniciar Sessão” (Login).

- Enter your NIF as the username and use the temporary password provided in the mailed letter.

Changing the password for security

After logging in for the first time, it is essential to change your temporary password to a secure, personal one. This is a critical step to protect your account and prevent unauthorized access.

To change your password:

- Navigate to the account settings or look for the option labeled “Alterar Senha”.

- Choose a new password that meets the required criteria (usually 8-16 characters, a mix of numbers and letters).

- Confirm the new password and save the changes.

It is highly recommended to choose a strong password that is not easily guessable to enhance security.

Setting up security questions

When changing your password, you will also have the opportunity to set up security questions. These questions will help you recover your account in case you forget your password in the future. Setting up security questions is another layer of protection to safeguard your account on the Portal das Finanças and keep your sensitive tax information safe.

Troubleshooting and assistance

What to do if you don’t receive the password? If your temporary NIF password does not arrive within the expected 3 to 4 weeks timeframe, you should take immediate steps to resolve the issue:

- Check your tax address. Ensure that your registered tax address in the Finanças system is correct. Errors in your address may delay or prevent the delivery of your password. You can update your address online via the Portal das Finanças or by contacting the tax authorities.

- Verify mail delays. If there are any known delays with postal services (especially if you live outside Portugal), check with the local postal service for potential reasons for delays.

- Request password again. If the delivery window has passed, you can request a new password through the Portal das Finanças or by contacting their support team directly.

If you encounter issues receiving your password or need further assistance, you can contact the Autoridade Tributária e Aduaneira (AT) using the following options:

- E-Balcão. This is the electronic support service available on the Portal das Finanças, where you can submit questions and check the status of your reques.

- Phone support. You can reach the Tax and Customs Call Centre (CAT) at +351 217 206 707, available on weekdays from 9:00 a.m. to 7:00 p.m..

- Local tax office. If the problem persists, visiting a local tax office in Portugal may help resolve the issue more directly.

By following these steps, you can troubleshoot potential issues and ensure you receive your NIF password as promptly as possible.

FAQs on password requests

How long does it take to receive my password?

On average, it takes 5 to 14 business days for domestic addresses and 3 to 4 weeks for international addresses or when using a fiscal representative.

Can I request the password by email?

What should I do if I lose my password?

You can reset it through the Portal das Finanças, either online or by requesting a new one to be mailed to your address.

Last updated: 02.10.2024