Understanding Rental Options in Spain Renting a home in Spain can be simple if you follow a few clear steps. This page explains how to find a place, sign...

Portugal has extended the deadline for its new tax regime for foreigners, offering a crucial window for investors, researchers, and entrepreneurs to take advantage of the country’s business-friendly policies....

Portugal has introduced the Fiscal Incentive for Scientific Research and Innovation (IFICI) program, a new tax regime aimed at attracting highly qualified professionals to relocate for both residence and...

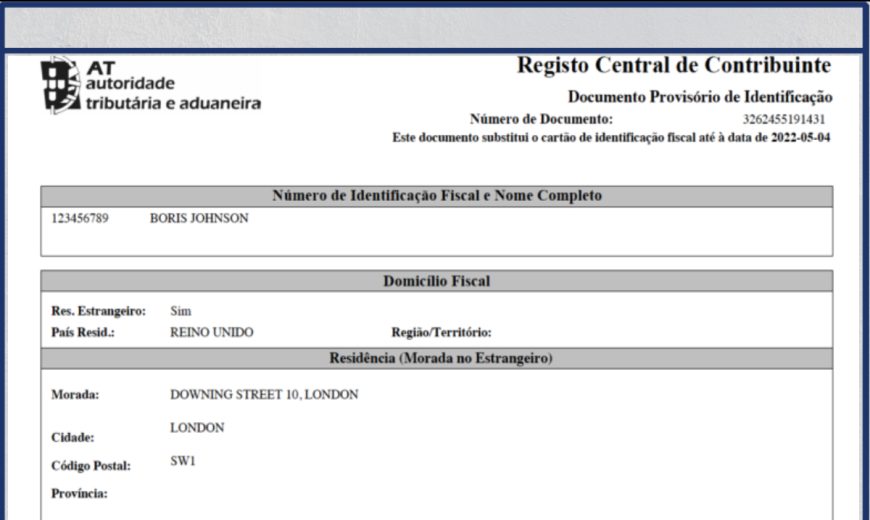

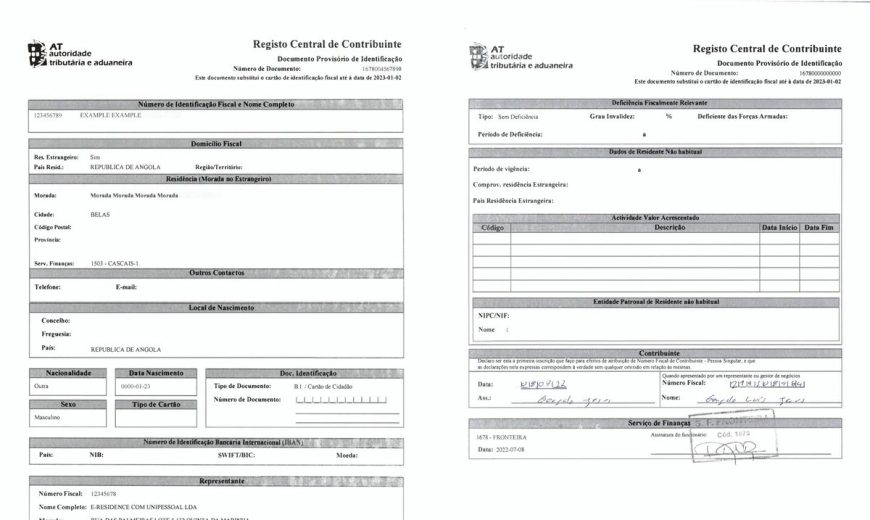

O Número de Identificação Fiscal (NIF) é um elemento fundamental no sistema fiscal português, vital para qualquer pessoa que deseje estabelecer residência, trabalhar ou realizar transações financeiras em Portugal....

For non-residents, obtaining a Portuguese NIF (Número de Identificação Fiscal) is essential for participating in Portugal’s financial and legal systems. This tax identification number is mandatory for activities such...

Driving in Portugal offers a fantastic opportunity to explore the country’s stunning landscapes and vibrant cities. Whether you’re visiting as a tourist or staying for an extended period, understanding...

Portuguese citizenship by descent is a legal process that allows individuals with Portuguese ancestry to obtain Portuguese citizenship based on their familial ties to Portuguese nationals. This pathway is...

The Serviço de Estrangeiros e Fronteiras (SEF), or the Immigration and Borders Service, is a key institution in Portugal responsible for implementing the country’s immigration and border control policies....

The SNS Number, also known as the Número de Utente, is a unique identifier essential for accessing Portugal’s public healthcare system, the Serviço Nacional de Saúde (SNS). This number...

Portuguese citizenship is highly sought after due to its numerous benefits and the variety of pathways available for obtaining it. As a member of the European Union, Portugal offers...