- You have to log in your personal account on Finanças website. You get the codes of access in a paper letter sent to your address after you registered your NIF. ( If you used our services to obtain NIF – the codes were forwarded to you by e-mail)

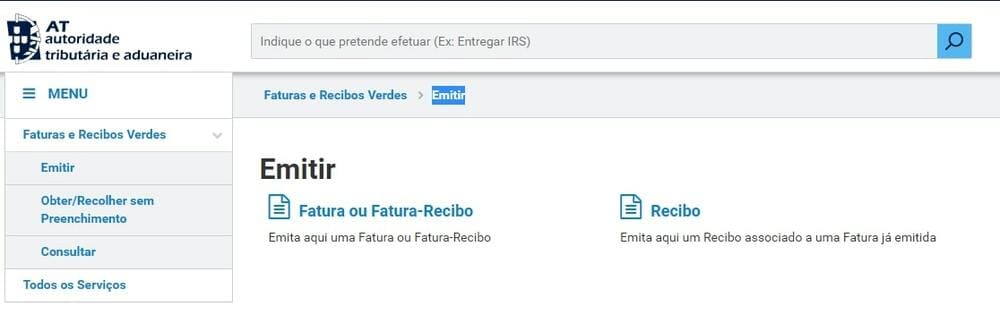

2. Enter the section “Faturas and Recibos Verdes” and choose “Emitir“

You have to choose which kind of invoice you want to emit. Fatura – is a proof of provided services, Recibo – proof of receiving a payment, Fatura-Recibo – proof of both, provided services and received payment, it’s the most convenient option.

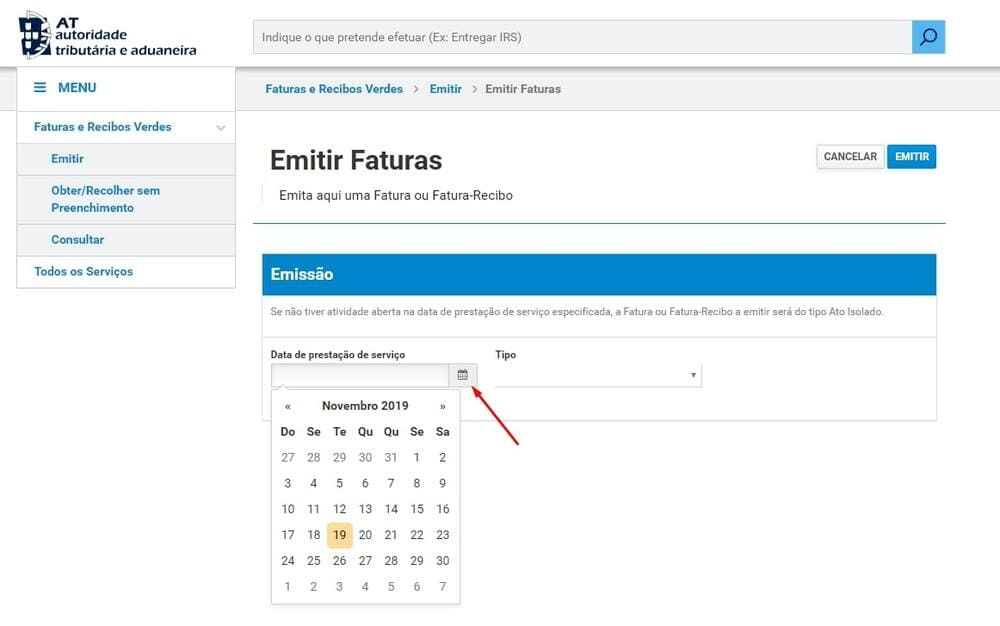

3. Click on Fatura-Recibo and choose the date of providing the services.

4. Choose the type of invoice.

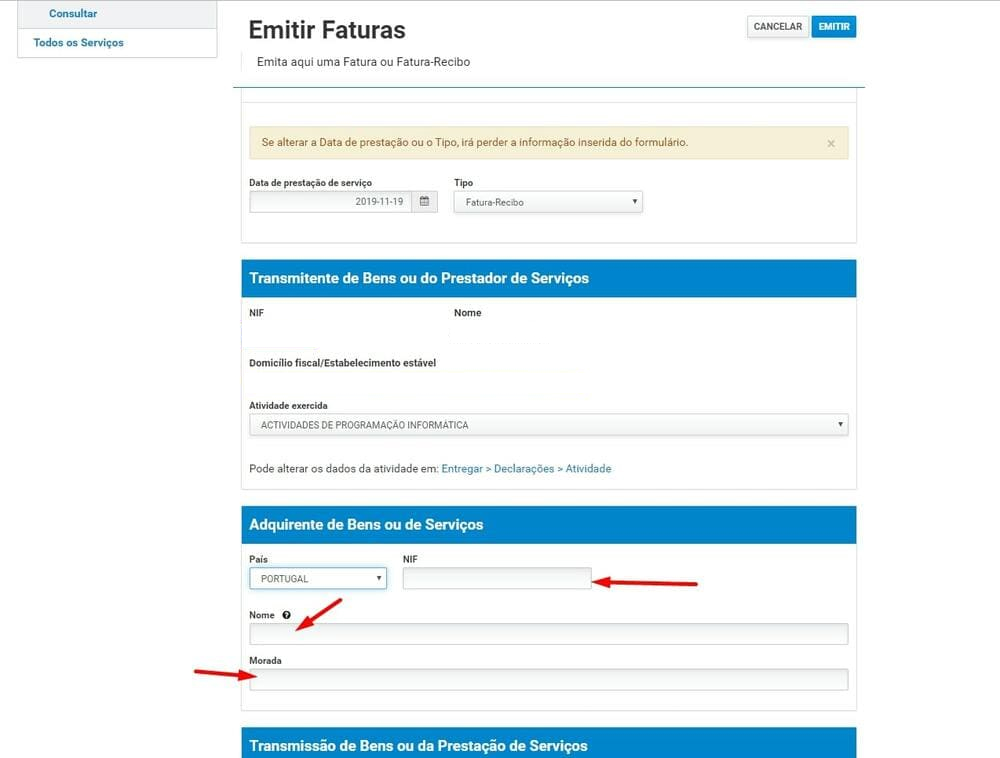

5. Write down the Portuguese Tax Number of your client (NIF), his name of the name of the company (Nome) and address (Morada).

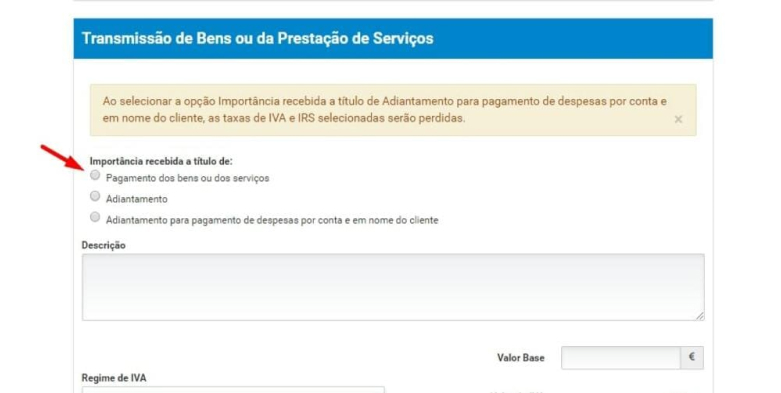

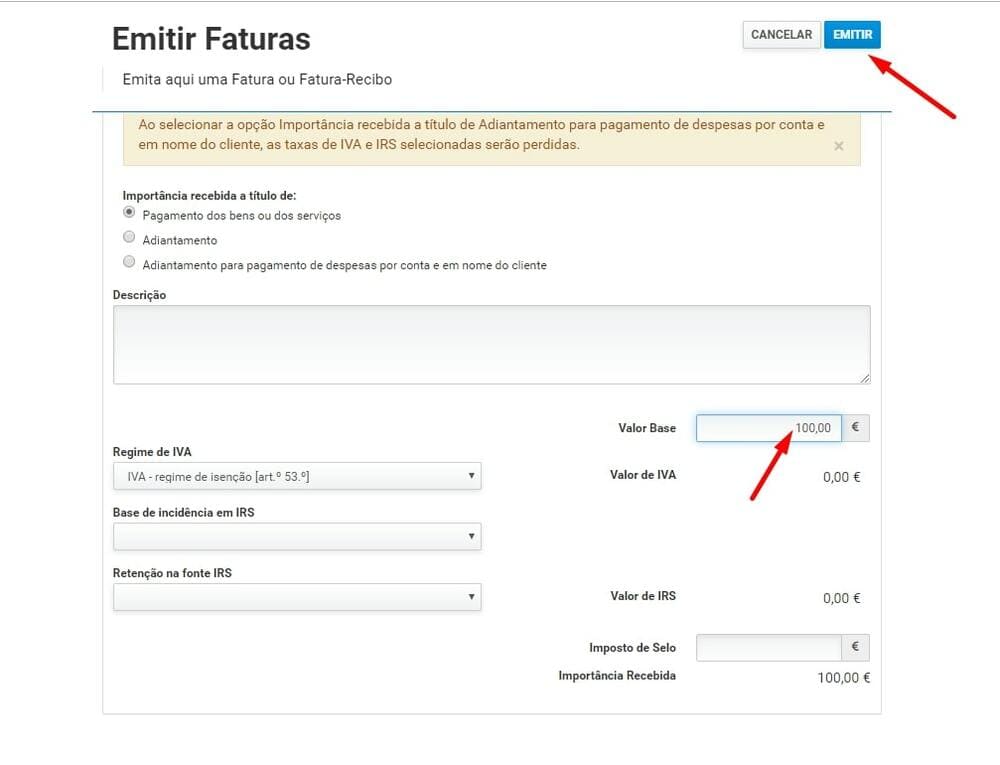

6. Choose the type of the payment. Pagamento dos bens ou dos serviços – is the most convenient option for most of freelancers.

Adiantamento is used for the advance payment, later it’s necessary to emit a Fatura-Recibo for all amount, and Adiantamento para pagamento de despesas por conta e em nome do cliente – if you pay for supplies or services from the name of the third party. For example, purchase of materials for constructions by a worker on the name of the client (it’s connected to the VAT differences).

7. In the description (Descrição) you have to write about your services or products you sell. Short description in general will be enough, for example: programação web (web programming), produção de conteúdo (creating of content) or simply prestação de serviços (provision of services).

8. Then choose the way of VAT calculation. It may vary depending on the type of business and regions of Portugal. If turnover of your professional activity doesn’t exceed 10.000EUR per year, you are exempted from paying VAT and you have to choose “Regime de isenção, Artigo 53“.

Then it’s required to choose the base, that will be taxable with income tax. If your turnover is less than 10.000EUR you have to choose “Sem retenção – Art. 101., nº1 do CIRS“.

If the turnover is more than 10.000 EUR it’s better to consult with an accountant, there are more nuances affecting the regime.

9. After write down the sum and press “Emitir“.

Now your invoice is ready to be sent to your client.

On the page “Consultar” you can find a full list of your emitted invoices.